Bargain: 10 Emmott Place in Charnwood sold for $643,000. Values have grown 4 per cent in the Belconnen suburb over the last quarter. Photo: LJ Hooker/Zango.

Canberra’s residential market held steady during April, with prices flat after a first quarter jump that suggested property was again on the move.

But the market took stock, registering a 0.2 per cent blip, according to the latest CoreLogic Home Value Index.

House values were only just in the black at 0.1 per cent, while units were only slightly higher at 0.2 per cent.

The overall median value was $847,000, still the second highest in the country after Sydney.

CoreLogic head of research Eliza Owen suggested this may have kept the lid on prices as the affordability factor pushed buyers towards better value areas and building types.

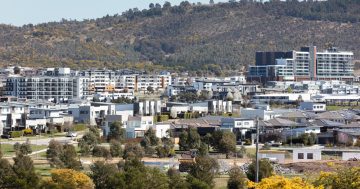

She said the largest value increase in the last three months was in Charnwood, at 4 per cent, where the median value is $680,000. Last week, a three-bedroom home in the Belconnen suburb sold for $643,000.

The biggest growth in unit values was in blue-ribbon Forrest at 4.1 per cent with a median of $928,000. Last week, a three-bedroom townhouse in the select inner south suburb sold for $2.725 million.

“There has been a broad trend amid the higher interest rate environment where we’re finding buyers compromise on either distance to CBD or space,” Ms Owen said.

She said that those looking in more desirable parts of Canberra could be pivoting to the units sector, while buyers chasing a family home with detached houses and land skewed demand towards the affordable pockets of metropolitan markets.

CoreLogic data showed supply was holding up well in Canberra, in contrast to other capitals, with new listings data similar to the past five-year year average.

Unit development across Canberra continued to be “pretty strong, both in terms of completions and what’s in the pipeline”.

“That steady rate of supply is probably helping to moderate price growth to some degree,” Ms Owen said.

There are 106 auctions listed in the ACT for the week ending 5 May.

Properties were moving faster over the past three months than in the previous period, with median days on market at 48 down from 63.

“It looks like there has been a bit of rundown in days on market which coincides with the increase in values and suggests slightly better selling conditions,” Ms Owen said.

Overall, the market seemed to be finding a relatively decent balance of supply and demand that was contributing to the slow, steady growth rate, which was not bad news for buyers or sellers.

Uncertainty about how interest rates will play out in coming months would also be a factor, with Ms Owen saying the forecasts were now all over the shop due to persistent inflation.

Nationally, home values continued to rise, especially in the mid-sized capitals, defying economic conditions. Put simply, there just aren’t enough properties to meet demand.