Canberra’s market continues to tighten, and rents keep rising. Photo: File.

A flood of professionals taking up work in the national capital is putting the squeeze on the Canberra rental market, sparking unofficial bidding wars from desperate prospective tenants and hiking rents to record levels.

It is also putting more people at risk of homelessness, and pushing more into housing stress, according to the ACT Council of Social Services, which is calling for a significant boost to affordable housing supply.

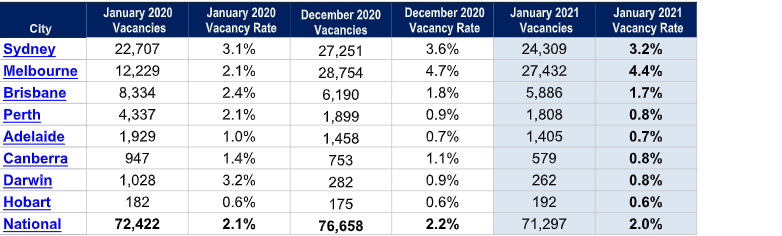

The latest data from SQM Research shows the ACT’s vacancy rate tightened further in January to 0.8 per cent from 1.1 per cent the month before, and average rents are again the highest in the country.

The number of vacancies in January 2020 has almost halved for the same period this year, down from 947 to 579.

Daily Digest

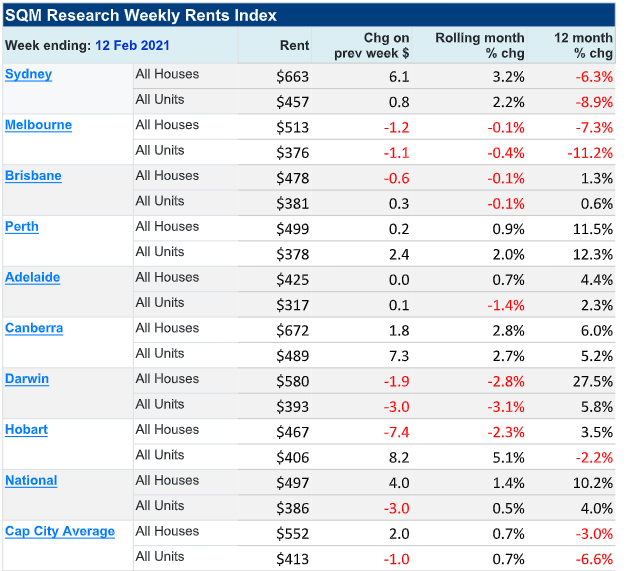

Weekly rents to 12 February for the few houses available have risen 2.8 per cent to an average of $672, while the more plentiful units went up 2.7 per cent to be closer to breaching the $500 mark at $489.

This represents increases over the 12 months of 6 per cent for houses and 5.2 per cent for units.

SQM Research vacancy and vacancy rates across Australia. Image: SQM Research.

As expected, the outer suburbs offer the cheapest rents with Tuggeranong the lowest average unit at $473, Belconnen $475 and Gungahlin $481.

Belconnen and Tuggeranong are the only districts with average house rents under $600, at $582 and $598.

The Inner North is the most expensive area to rent in Canberra with houses at $836, and units at $586. Across the lake, the Inner South is a little cheaper at $737 and $520.

The second most expensive area for houses is the Woden Valley, with a weekly average rent of $741, while units are now just over $500 at $501.

In nearby Weston Creek, landlords are asking $689 for houses, and $496 for units.

General manager of property management at Independent Grace Hooper said the company has about 3500 properties under management, but the vacancy rate was only 0.13 per cent.

“It’s just crazy,” she said.

Ms Hooper said professionals and graduates were relocating to Canberra this year in numbers not seen for many years, and not just for the public service.

Open homes were attracting groups of between 10 to 20, but in a sign that supply was tight, many are returning after failing to secure a property.

She confirmed that many were also offering to pay more than the asking price, although owners were encouraged to choose tenants who were the right fit for their property.

A screenshot from a website where tenants apply for rental properties sent to Region Media shows recent applications in Lyneham, with a three-bedroom house advertised at $700 a week, attracting offers of $750 and $780.

Ms Hooper said situations such as the latest Melbourne lockdown were likely to drive even more people to what may be considered safe locations.

“We have been so sheltered in Canberra in comparison, it is starting to look like a good option. From what I hear, Brisbane is the same,” she said.

Weekly rents index. Image: SQM Research.

ACT Council of Social Services policy manager Craig Wallace believes any rush to Canberra will accelerate what was already an existing problem of low to middle-income people being priced out of the rental market.

He said there were already 9500 people in rental stress, in which they cannot maintain rental payments without spending more than a third of their income and compromising on other things such as food and clothing.

While more government spending on homelessness services in the Budget was welcome, what was really required was a significant influx of affordable supply in Canberra, beyond the amount already promised.

“So we can’t just keep putting Band-Aids on a bad situation and hope it will get better by itself,” Mr Wallace said.

“We need not just hundreds of homes as committed to in the [government’s] housing strategy, we need thousands of new affordable dwellings if we aren’t to see larger groups of people slipping into homelessness and even ending up as rough sleepers on Canberra streets.”

He said more land needed to be released to construct public, social and community housing at a scale that would take some of the pressure off the market.

“People are only two or three steps away from the abyss, and because our prices are really really high there are even two-income households with no children on basic wages who you would assume would be relatively secure and comfortable but aren’t. They cant afford to miss a paycheque,” Mr Wallace said.