Off-the-plan apartments will be cheaper. Photo: Michelle Kroll.

Purchases of off-the-plan properties priced up to $500,000 will no longer have to pay stamp duty as part of the next phase of tax reform starting on Thursday (1 July).

The new stamp duty regime will mean savings for all property buyers, but the ACT Government is trumpeting the benefits for buyers at the lower end of the market and how it should also boost the supply of more affordable homes under $500,000.

It comes in addition to the existing home buyer concession scheme which has a range of eligibility criteria.

Chief Minister Andrew Barr said anyone purchasing an off-the-plan apartment or townhouse valued at $500,000 will save $10,360.

“It’s $10,360 they no longer have to save or borrow when buying in the ACT,” he said.

“This is a further step in our tax reform program and one that encourages an increased supply of housing below the $500,000 threshold.”

Mr Barr said the government’s priority through the next phase of stamp duty reductions was focused on the most affordable end of the housing market.

“If the government hadn’t started this reform back in 2012, and the government had continued to raise revenue in the same inefficient way, buyers would be paying $20,500 in stamp duty for the same property that will, from tomorrow (1 July 2021), permanently have zero stamp duty in the ACT,” he said.

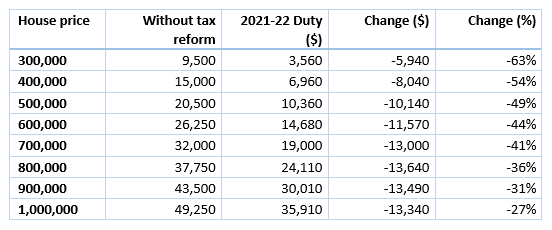

This table shows the stamp duty savings over the tax reform period since 2012:

Stamp duty savings Image: ACT Government.

Mr Barr said the government would also cut stamp duty across a range of property purchases in the ACT. Duty on any owner-occupier purchase between $200,000 to $1,455,000 will be $1,040 lower in 2021-22 than in 2020-21.

“The ACT has been leading the country in removing inefficient taxes that significantly increase the cost of buying a home,” he said.

“Since 2012, we have been reducing stamp duty in the Territory, and this will continue throughout this term of government.”

Mr Barr said that by abolishing inefficient taxes such as stamp duty and replacing this revenue with the fairest and most efficient tax base, household rates, the government was increasing economic activity in the ACT and supporting housing affordability.

“Whether you’re looking to purchase your first home, downsize or upsize, the reduction of stamp duty rates will make it easier to purchase and ensure all Canberrans will benefit from fairer, simpler and more efficient taxes and duties,” he said.

Find out more by visiting revenue.act.gov.au.