The view from 201 Annetts Parade, Mossy Point, a waterfront top seller in 2022, which sold in January for $3,350,000. Photo: Zango.

Interest rate rises may have temporarily taken the wind out of the sails of the South Coast property market but continued sales of higher-end properties and fewer listings mean most of the spectacular gains of the COVID period have been retained.

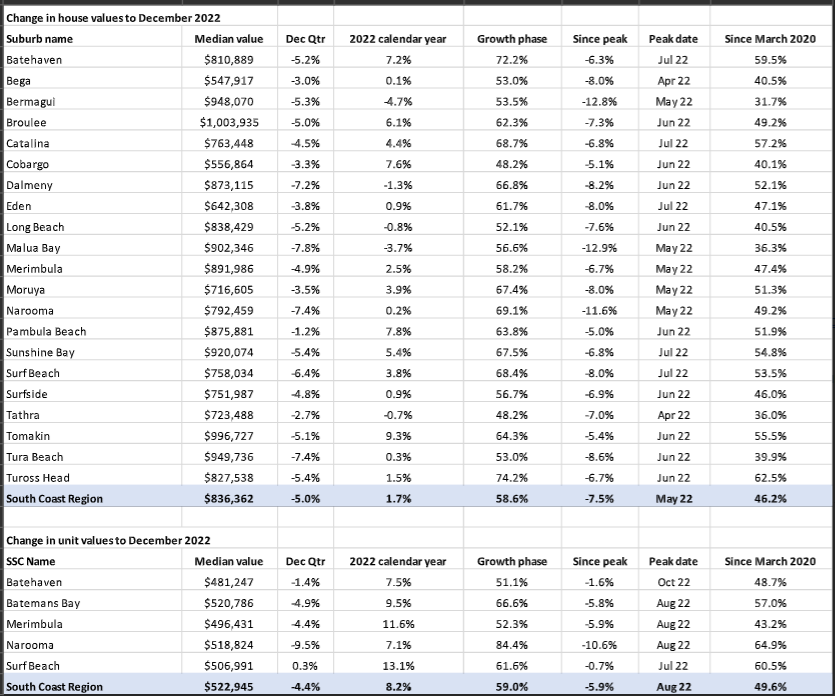

CoreLogic data shows both houses and unit prices leapt almost 60 per cent in the growth phase to last year’s peak in May when the Reserve Bank launched its war on inflation.

Since then, house prices have receded – but only 7.5 per cent to a median of $836,362 in December, and units -5.9 per cent to a median of $522,945.

CoreLogic Research Director Tim Lawless said the biggest gains for houses were recorded at Tuross Head (74.2%), Batehaven (72.2%), Narooma (69.1%) and Catalina (68.7%).

The unit market recorded a slightly higher capital gain relative to houses, but Narooma stood out with an 84.4 per cent surge in values.

The biggest declines in house prices from the peak have been in Malua Bay (12.9%), Bermagui (12.8%) and Narooma (11.6%), while Narooma unit prices have eased 10.6 per cent off its big high.

But the smallest declines have been across the Surf Beach unit market (-0.7% from the recent peak), followed by Batehaven unit values (-1.6%) and Pambula house values (-5.0%).

Mr Lawless said much of these gains were here to stay.

“Although values are now falling, its highly unlikely we will see the region erase the recent gains, considering house values remain 46.2 per cent above pre-COVID levels and unit values are 49.6 per cent [higher],” he said.

Mr Lawless said house and unit values were likely to continue to trend lower as interest rates rise further and population trends partially normalise.

“There is already evidence the rate of internal migration to regional Australia has slowed relative to the highs of 2021 and 2021, but the resident population is likely to remain larger than it was pre-COVID as more people take the opportunity to work remotely,” he said.

South Coast house prices. Image: CoreLogic.

Premium & Waterfront Specialist at McGrath Batemans Bay John Haslem said the Reserve Bank’s aggressive stance had dented consumer confidence, but it was only in the last quarter of 2022 that the market really felt its impacts.

Mr Haslem said the investor and first home buyer residential market had collapsed but the higher priced properties were still selling, albeit at a reduced rate, to the wealthy or recently retired who were not put off by interest rate hikes.

“Basically, what has happened is the market has slowed down and it’s only in the last month or so that there have been indications that sellers are willing to take lower prices for their houses,” he said.

The median house price from Durras to Broulee grew from $550,000 in 2021 to $850,000 in 2022 and had not fallen greatly, buoyed by greater interest in small acres and non-waterfront lifestyle properties.

Mr Haslem said the number of sales and interest fell noticeably from September, with monthly sales halving from 100 to 50.

“Interestingly, the fall-off was predominately in the lower end of the market because those sales were usually first-home buyers and investors,” he said.

Before then, broad interest, including from traditional Canberra retirees and Sydneysiders picking up comparatively cheap holiday houses or relocating, had driven record prices, particularly near or on the water.

“Three years ago there were only about a dozen sales a year over $1 million and they were usually on the waterfront,” Mr Haslem said.

“In the first nine months of 2022 there were over 100 sales over $1 million, and some not on the waterfront, and you couldn’t find waterfront property under $2 million.

“So we went in three years from very few waterfront properties over a million to very few under $2 million.”

Only last week a property sold for a record $4 million, and two sales in the last three months went close to $3 million.

But Mr Haslem said that with rate rises hitting confidence, many buyers would be reluctant to pay current prices, and supply had dwindled as owners held back properties.

“They’re having to pay double now what they paid three years ago,” he said.

“People will probably keep their hands in their pockets, hold back from buying unless they have a feeling that something’s on the market that might be a bit of a bargain and that really requires someone who needs to sell.”

Supply had also shrunk from about 400 to 500 properties on the market in early 2022 to only 60 or 70 now.

But Mr Haslem expected some investors who purchased in late 2021 and the first half of 2022 would start feeling the pain of high-interest rates so those properties might come on the market.