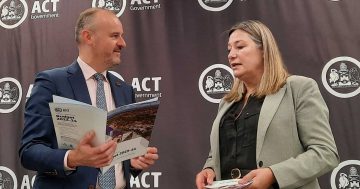

Chief Minister Andrew Barr has welcomed news that the ACT has retained its AAA credit rating.

The ACT has retained its AAA credit rating and the territory’s financial management compares favourably to domestic and international peers, according to S&P Global Ratings.

However, the outlook for the ACT remains negative because of pressure on the Federal Government’s rating – meaning that if the Commonwealth’s rating is downgraded then the ACT’s would be too.

Apart from this, the ratings agency is upbeat in its assessment of the ACT economy, yesterday affirming both its short-term and long-term AAA rating for the territory.

“The ratings on the Australian Capital Territory (ACT) reflect its wealthy economy and financial management, which we believe will successfully deliver its infrastructure plans, while maintaining high liquidity coverage and containing debt levels,” S&P Global Ratings said yesterday.

“After updating our forecasts until 2020, we expect the ACT’s financial management to successfully deliver its infrastructure plans, including private public partnerships (PPPs), and the Asbestos Eradication Scheme (AES), while containing debt levels and maintaining high levels of liquidity coverage.”

The ratings agency said that the ACT has successfully addressed a number of challenges, including the global financial crisis in 2008-2009, and Commonwealth government fiscal consolidation.

“It is also addressing the substantial costs involved in remediating asbestos issues in private dwellings within budget,” S&P Global Ratings said.

“Further, it is reforming its tax system toward a more stable income source and away from volatile conveyance duties.”

However, the ratings agency said that the ACT Government has allowed expense growth to outpace revenue growth for several years, weakening its operating position.

“This partly reflects strong growth in employee expenses, including superannuation, of about 9% per year during the past two years. We forecast employee expense growth to slow, particularly after some one-off expenses were incurred in 2016,” the ratings agency said.

“If growth continues at this pace, however, it would pressure the budget, especially in the event of a downturn. This is because employee expenses are generally inflexible and difficult for governments to reduce.”

ACT Chief Minister Andrew Barr has welcomed news that the ACT has retained its AAA credit rating in the report released yesterday.

“We have achieved this because of our strong and balanced approach to economic management,” said a spokesperson for Mr Barr.

“The report showed the ACT continues to have a strong economy, while the ACT Government is successfully delivering on our infrastructure plans while containing our debt levels,” he said.

“By investing strongly in health, education and transport infrastructure, we’re not only delivering the services Canberra needs for the future, we are creating jobs and providing ongoing economic strength right now.

“The negative outlook S&P has applied to the Commonwealth is reflected in the ACT’s rating. Under S&P’s reporting, no state or territory jurisdiction can have a higher credit rating than the Commonwealth.”