A strong supply of apartments and townhouses is offering the best value for buyers. Photo: Michelle Kroll.

Canberra’s residential property market weakened further in September as a rise in spring supply outstripped demand.

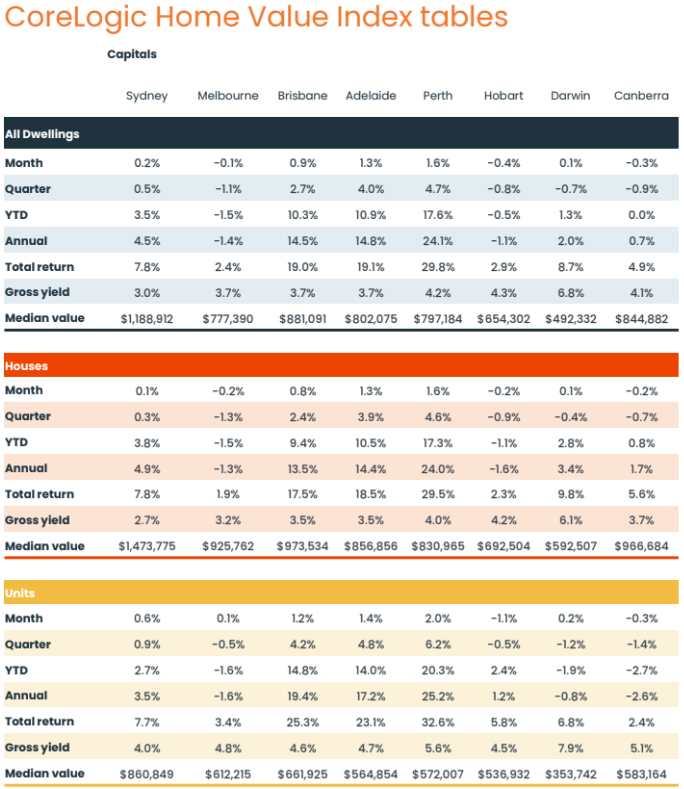

According to CoreLogic’s Home Value Index, the overall dwelling price slipped -0.3 per cent, houses -0.2 per cent, and units and townhouses -0.3 per cent.

But it has been only over the last quarter that the market has shown that weakness after months of steadiness, with an almost -1 per cent drop overall, -0.7 per cent for houses and -1.4 per cent for units.

The market is still in the black overall for the year and for houses, but units and townhouses are down -2.6 per cent, reflecting the increased supply as projects complete.

But it has differed across the districts.

The biggest falls over the past 12 months have been in the newer areas such as Molonglo (-1.3%) and Gungahlin (-1.6% ), while Tuggeranong (2.7%), North Canberra (1.6%) and Belconnen (1.5%) led the rises.

CoreLogic executive research director Tim Lawless said the market was still holding its value, but it did favour buyers who were enjoying more choice, and vendors were more prepared to negotiate to move their properties.

“The listings trend is definitely picking up and that’s probably one of the factors behind some of the weakness we’re seeing in the market,” he said.

“With vendors becoming more active, there doesn’t really seem to be a commensurate rise in purchasing activity.”

Across dwelling types, values fell in the ACT. Table: CoreLogic.

While affordability was a broader issue generally, it was not so much in the ACT, where prices were high, but so were incomes.

“Compared against local incomes, dwelling value-to-income ratios are sort of down around the bottom of the league table,” Mr Lawless said.

“You’ve got markets like Darwin and Canberra with a dwelling value-to-income ratio around the six to seven times which, at least in relative terms, is pretty healthy.”

He said any softness in demand stemmed from fewer people moving to the ACT from interstate to live and a reduction in migration.

“That’s been the case for a couple of years now,” Mr Lawless said.

“Overseas migration is winding down as well, which is probably more of a factor for rental demand than purchasing.”

The other factor would be sentiment due to interest rates and cost of living.

Mr Lawless said it had definitely become a two-tier market, with house values actually up nearly 2 per cent over the past 12 months while units and townhouses had fallen 2.6 per cent.

“There’s a clear difference between those broad types of housing detached homes holding the value much better,” he said.

“Unit markets are still sort of moving through a hangover of supply.”

This is an example of how new supply could keep a lid on housing prices.

Mr Lawless did not expect to see prices take off in the near future, even if there was a rate cut due to regulators keeping a close watch on borrowing limits; in fact, over the next three months, he expected to see Canberra’s market fade a little further as the current conditions continued.

Not that the market has not seen properties fetching good prices.

CoreLogic says that in August one unit market, Yarralumla, and 45 house markets, or 36.2 per cent of the 127 suburbs analysed, had a seven-figure median value.

Six suburbs rejoined the million-dollar club for houses after they dropped out in 2022 and 2023. Cook, McKellar, Macarthur, Chifley, Gowrie and the suburb of Gungahlin each saw their median house value rise above the $1 million mark over the year.

However, values in these suburbs remain between -4.2 per cent and -15 per cent below their previous peaks.

Gowrie re-entered the million-dollar club in July and has since recorded a new record peak, with a median value of $1,018,175.