Properties are taking longer to sell because there is more choice and fewer buyers. Photo: Ian Bushnell.

Canberra’s residential property market ended the year on a quiet note and was flat over the 12 months, but the Molonglo Valley district has stood out from the rest with a 5 per cent rise in values.

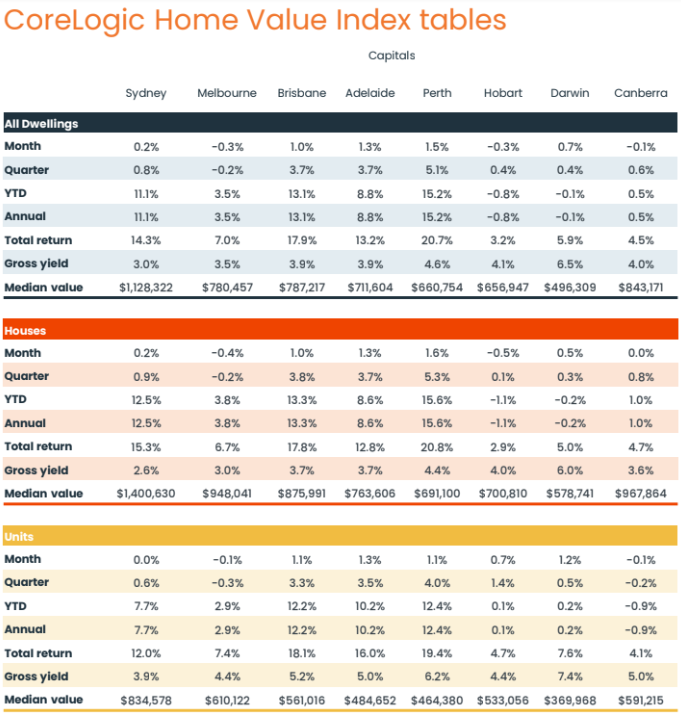

CoreLogic’s Home Value Index for December shows prices in the national capital unmoved from the previous month and barely shifting over the year, with an increase of just 0.5 per cent and a median value of $843,864.

House values for the year are up 1 per cent, finishing with a median value of $967,864, while units and townhouses slipped -0.9 per cent for a median of $591,215.

Canberra, Darwin and Hobart all had soft years while Sydney led the way among the other capitals, along with Brisbane and Perth, posting double-digit gains driven by a lack of supply and high immigration, although the heat has come out of these markets during the second half of the year.

Despite this, Canberra remains the second most expensive capital to buy a home, behind Sydney, and values are still 31 per cent higher than before the pandemic.

Across the ACT, the CoreLogic data shows people buying into the growing Molonglo Valley making the biggest gains with a 5 per cent increase in values in 2023 for a median of $760,555.

North Canberra comes next with a much smaller 1.3 per cent gain for a median of $834,579, but the other districts ranged from a 0.9 per cent increase in Tuggeranong ($817,048) to a fall of -0.4 per cent in the Woden Valley ($978,881).

Weston Creek ($931,039) edged up 0.4 per cent, Belconnen ($810,144) 0.3 per cent, and South Canberra ($868,197) 0.2 per cent, while Gungahlin ($900,268) was flat.

Canberra remains the second most expensive capital to buy a home. Image: CoreLogic.

ACT values are still 6.3 per cent below record highs.

CoreLogic Research Director Tim Lawless said Canberra experienced a stable market in 2023, with a lot more supply available to buyers and less urgency in the market.

He said November listings were 14 per cent above the five-year average and 21 per cent higher than the same time in 2022.

Another factor was that it took longer for new stock to be absorbed, with a fall-off in demand.

Mr Lawless agreed that this could be due to affordability pressures, potential buyers waiting for interest rates to come down, and less interstate migration.

“We can still see sentiment is still very low and that has a big impact on purchasing decisions,” he said.

“Throughout the second half of next year, if we do start to see a growing consensus that interest rates might come down, that’s when we’ll see a pickup in sentiment and a little more confidence in decision-making.

“If that happens, we probably will see housing prices responding positively on the back of increased activity.”

But across the country, more supply of new housing was needed and while construction costs were not rising as quickly, there were still shortages of labour and materials, and builders’ margins remained tight.

Mr Lawless said the Federal Government faced a big challenge in achieving its target of 1.2 million well-located homes over the next five years.

“Hopefully, this year is more focused on fixing more of the foundational aspects of the construction sector and using that as a launch pad for getting more supply into the marketplace next year,” he said.