New stock, such as Ivy in Woden, has come on stream but the ACT rental market remains very tight. Photo: File.

Last year’s legislation to make life easier for renters is having unintended consequences, including higher rents and an even tighter rental market, according to property group Independent.

As students line up to inspect properties and the annual worker influx begins, Independent Property Management managing director Hannah Gill says a combination of high rates and charges, greater rights for renters, and CPI limits on rent increases have seen many investors desert the ACT market and landlords ratchet up rents to the maximum allowed.

The cost of housing in the ACT is an ongoing issue, with rents for both houses and units second only to Sydney.

While new data suggests rents are steady or marginally down over the year, Ms Gill says Independent is seeing rents continuing to climb on its rental roll, which is dominated by units.

“We’ve seen a nearly $18 increase year-on-year for average rents in our portfolio,” she said. “The December 2018 average was sitting at $448 and last month at $466. That’s quite a significant increase year-on-year.”

Weekly Rents Index. Image: SQM Research.

Ms Gill said that perversely, the CPI rent limitations applied in November were probably forcing rents up more quickly than they might have done otherwise.

“It’s the unintended consequences we were worried about,” she said.

While the completion of several major unit developments such as Ivy in Woden had added some stock, and there was more on the way this quarter, Ms Gill said investor numbers were still down, limiting the number of rental properties coming on to the market.

“Four years ago we were seeing half of the development snapped up by investors and now from what I’m seeing it’s 10 to 15 per cent,” she said.

Ms Gill said the legislation, which also made it easier for tenants to keep pets, and increasing strata fees, rates and taxes had created a lot of angst for investors in the market and they were looking at other investment options.

Ms Gill’s comments come as new data shows a slight improvement in the residential vacancy rate for December, compared with November and the same time in 2018.

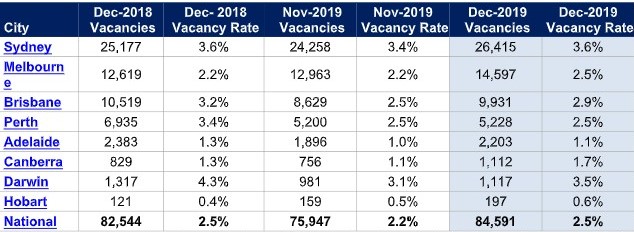

Vacancy rates in capital cities. Image: SQM Research.

SQM Research said the rate for December was 1.7 per cent, up from 1.1 per cent the previous month and 1.3 per cent in 2018.

But this is still a very tight market, Ms Gill says, and the data reflects the traditional increase in December as workers and students leave the ACT, and probably the arrival of fresh stock.

The situation was challenging as the ACT entered its peak season because there was not enough variety of accommodation available, particularly houses for families, she said.

Demand from students was already significant, with large groups at open homes recently.

Ms Gill said her leasing team conducted two open homes for one-bedroom apartments in Belconnen last weekend, with 34 people attending the first inspection and 35 the second.

She said other areas of high demand were pet-friendly properties and homes in desirable school zones.

SQM Research said weekly asking rents in the ACT to 12 January was $633 for houses, about 2 per cent down on the previous month, but steady over the year, and second only to Sydney.

Units were $465, again only second to Sydney, and slightly up on the previous month but slightly down on the year.