Top seller: 2/50 Savige Street, Campbell, sold for $1.885 million. Photo: home.by holly.

The fall in the Canberra property market continues to slow, with values slipping just 0.5 per cent in February, but the spectre of more interest rate rises remains after the Reserve Bank persisted with its hawkish outlook.

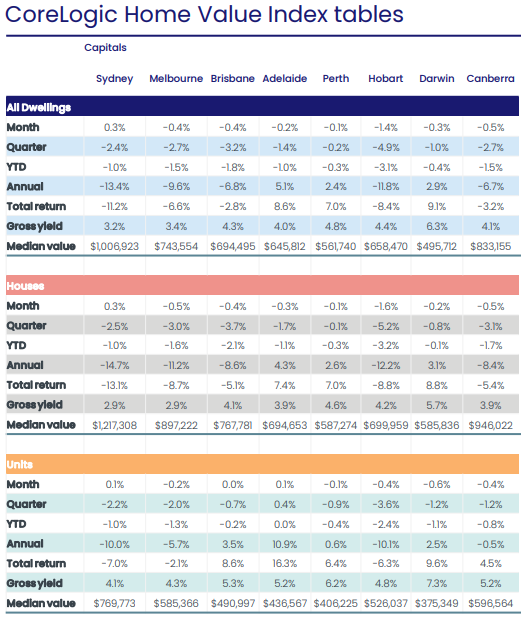

According to CoreLogic’s Home Value Index, price falls for houses, and units and townhouses were about the same at -0.5 and -0.4 per cent respectively, with median prices of $946,000 and $596,500.

But house prices have declined more over the past three and 12 months at -3 per cent and -8.4 per cent, while units and townhouses are flat, falling just 0.5 per cent over the year.

That reflects what one agent called the “craziness” coming off prices and the buyer shift to more affordable properties.

Auction numbers are back up after the summer break with clearance rates of about 60 per cent, although stock is hard to come by. Listings are rising, but they are still about 15 per cent down on the same time last year.

According to Zango’s auction report, there were still total sales of $43.9 million last week, with a top result of $1.8 million at Campbell and the median at $855,000.

CoreLogic Home Value Index Tables Febraury 2022. Image: CoreLogic.

A combination of Canberra’s strong employment, relatively high salaries and the transfer season continue to bolster the local market despite rising interest rates eating into buyers’ budgets.

Independent Woden and Weston Creek principal Mark Wolens said some people coming to Canberra for work were opting to buy rather than take their chances in the pricey and tight rental market.

“We all know we need more people to work in Canberra,” Mr Wolens said.

“That could be the thing that keeps the market on an even keel.”

Mr Wolens noted ‘livable’ apartments and townhouses were selling well and good quality houses remained in demand if they could be found, but properties that needed work were not moving as quickly.

“Where something needs a bit of work, people are factoring in the interest rates so they don’t have as much flexible cash,” he said.

CoreLogic identified Weston Creek, North Canberra and Woden as Canberra districts where values fell the most over the past year, with drops of 9 per cent, 8.4 per cent and 8 per cent, respectively.

Mr Wolens was not surprised as Independent had spotted last year that those suburbs were overheated.

“It was overly inflated pricing, really crazy pricing, people paying whatever to get into the market,” he said.

“We’ve knocked the craziness off it.”

Tuggeranong values fell 7 per cent, followed by followed Gungahlin (-5.8%), Belconnen (-5.7%), South Canberra (-5.6%) and Molonglo (-3.3 per cent).

Mr Wolens said the interest rate rises were a squeeze for households, but Canberra was luckier than the other capitals and there were still not that many people going to their financial limits for loans.

“Obviously, it’s affected the bottom end of the market and that’s where they are going into an apartment,” he said.

CoreLogic said the national index declined only 0.14 per cent in February, the smallest monthly fall since May 2022 (-0.13%), when the rate hikes commenced. In fact, Sydney values edged up 0.3 per cent.

But Tim Lawless from CoreLogic warned the distinct possibility of more interest rate rises could send home values plummeting again.

“Considering the RBA’s move to a more hawkish stance at the February board meeting, along with an expectation for a weaker economic performance and a loosening in labour markets, there is a good chance this reprieve in the housing downturn could be short-lived,” Mr Lawless said

“We also have the fixed-rate cliff ahead of us; arguably, the full impact of the aggressive rate hiking cycle is yet to play out.”

It could be late 2023 or early 2024 before interest rates stabilised and demand picked up again, Mr Lawless said.