Confusion remains for healthcare practice owners after recent court cases determined doctors were employees and payroll tax needed to be paid. Photo: RSM.

Two recent interstate court cases have left many medical and allied health practice owners more than a little concerned about what it could mean for their business.

The court cases relate to how medical centres engage doctors, and whether they are contractors or employees.

It’s fairly common practice for medical and allied health practices to bring on doctors or providers as subcontractors and take a percentage of their billings. As contractors, the business does not see them as employees and therefore does not pay any payroll tax.

However, the recent interstate court cases have created mass uncertainty about this arrangement after they determined the subcontractors were essentially employees. Both businesses were required to pay backdated payroll tax.

While we’re yet to see high-profile cases of a similar nature in the ACT, the increasing occurrence of these cases interstate could mean they are just over the horizon.

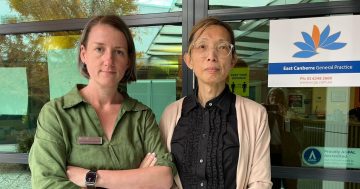

Principal at RSM Michael O’Hehir and the firm’s senior manager of business advisory, Young Han, say it’s important for Canberra practices to be aware of these rulings.

“Payroll tax is a tax that’s applied to businesses that exceed a threshold in total wage payments per year,” Michael says.

“In the ACT, the threshold is $2 million which means businesses that operate here do not pay payroll tax until their total taxable wages reaches $2 million or more. So these recent court cases would only apply to larger medical centres or allied health businesses.

“However, our payroll tax rate is quite high at 6.85 per cent. A business that is ruled to owe backdated payroll tax could find itself in a very difficult predicament.”

RSM Australia principal Michael O’Hehir. Photo: RSM.

Michael encourages practice owners to review their arrangements with service providers to determine if they are in any way similar to the circumstances surrounding the court cases.

“In the most recent case, the practice owners operated three medical centres and provided rooms for the doctors to see patients,” he says.

“Each fortnight, the doctors received 70 per cent of the claims paid by Medicare for patients they saw. But it seems =it was the employer’s level of control over the subcontractor that ultimately led the court to decide that these payments were more like wages.

“The subcontractors were bound by a service agreement that detailed the required hours of work, leave policy, and had other employee-like provisions.

“The practice determined which patients saw each doctor, when the doctors worked, and that the doctors had no right to substitute themselves with another person if they were sick or on leave.

“Patients were ‘owned’ by the practice and not the individual doctor, and there were constraints on the doctor leaving and setting up a practice nearby. Because most of the doctors worked exclusively for one of the medical centres owned by the practice owners, they couldn’t prove the doctors were in business and consulting to the public in general.”

Young says there may be a case the payments are exempt from payroll tax if the subcontractor collects their own fees, rents a consulting room, and uses the administration function of the practice for patient bookings. In addition, patient records will have to be owned by the doctor and not the centre.

This is unlikely to be seen as a desirable solution for medical or health practices though.

“There are two elements to consider, ‘relationship’ and ‘payment’, as they exist in many industries,” Young says.

“If you have a signed service agreement with correct terms and conditions, that is a good start. However, at present it is practically impossible to address ‘payment requirement’ without adequate banking and IT solutions unless each individually-contracted doctor is prepared to spend extra hours to reconcile payments.

“It really is a complex situation, and subcontractor arrangements like this do not just exist in healthcare – they exist in many industries.

“What’s important is for practice owners to understand these court rulings and consider the implications if they engage in these types of arrangements which could be subject to backdated, current and future payroll tax.

“For some medical centres which rely on a bulk bill strategy, making ends meet is already difficult. So it might be worthwhile having a chat with a business adviser who can help review arrangements, potential liability, and new solutions.”

To speak with an accounting professional who specialises in the health industry about your agreements and potential for payroll tax, contact RSM in Canberra on 6217 0300.