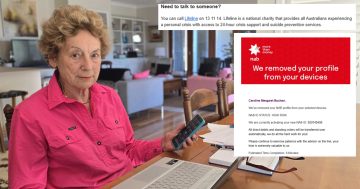

The mythical $7K Mazda that wasn’t. Photo: Facebook.

The ad went something like this: “$6,800. Selling this beautiful 2015 Mazda 3 for my Auntie Angela. Her email address is on the 2nd and 3rd photos. Do NOT message me here – I’m at work and can’t answer.”

It is a bit odd that someone who has the time to superimpose an email address on not just one, but two photos, can’t then find the disposable time to reply “yes” to an “Is this still available?” message, but hindsight is a wonderful thing. And when you’ve been sucked in by a scam, you get a lot of hindsight.

But when an offer is too good to be true, you tend to gloss over inconsistencies and find reasons to justify the bargain that’s just fallen in your lap. So maybe the sweet old lady had just enlisted her reluctant granddaughter to post an ad on “that new-fangled Face-thingo” – in this case, Facebook Marketplace.

Facebook Marketplace is rapidly becoming the go-to one-stop-shop for buyers and sellers in any given area. It’s easy, convenient, local and nearly everyone’s on it. Which is a problem. Where there’s meat, there’s flies. Scammers and their sneaky tactics and stories are breeding left, right and centre, and here’s the thing – they’re clever. So don’t ever feel stupid for getting duped. When you come across a scammer for the first time, you may well not know it – and that’s the point of a scam. It’s meant to be believable. And we want to believe.

Our “innocent until proven guilty” method of appraising people kicks in, the excitement bubbles up about what a good deal you’ve found, and a sprinkling of confirmation bias does the rest to ensure the warning signs remain hidden.

Classified scams, like the ones you’ll find on Facebook Marketplace, are used by both buyers and sellers alike and so far this year, have cost more than 7000 Australians more than $5 million. And that’s just what’s been reported.

I was almost one of them.

I responded by email, but it was then that the ‘little old lady’ image of the seller started falling apart.

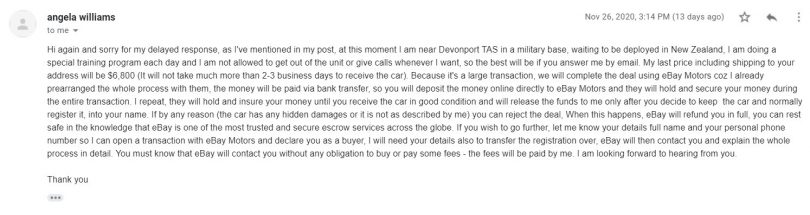

The tale she told was that she (if it even was a she) was in Tasmania but had to move to New Zealand for a “project”. She needed to sell the car quickly for the cash, and if we agreed to buy it, the car would be shipped to our address on the back of an RAAF truck (for nothing!)

We’d then have five days to try it out before she’d receive the money.

The generic “Hi there” prompted the first niggle, but the fact that our national defence force was shipping cars around for Auntie Angela came a close second.

The scam email received by James Coleman. Image: Supplied.

What followed was a couple of equally generic and confusing emails, during which she drew out my name, address and phone number, without supplying me with so much as the registration plate of the vehicle.

To settle the growing cold-sweats, I decided to dig around a bit.

I soon discovered that the very same Mazda was for sale on CarSales.com.au. Same photos, same kilometres, but in Victoria, and selling for a far more credible $15,000.

It also turns out the ‘granddaughter’ who had posted the Facebook ad lives in Argentina.

I forwarded all of these findings to the ‘Auntie’ and have heard nothing since. Gotcha.

But the truth is, I got lucky. Here’s how you can save yourself from scams.

1. If it’s too good to be true, it is

There are no exceptions. A 2015 Mazda 3 Maxx with 80,000 km for $6K? Rubbish.

I’m not suggesting you automatically assume every seller is a liar, but what I’ve learned is that if the messaging takes a turn for the weird, back away. Fast.

What you must never do is transfer any money until you’ve seen the actual car and the actual owner with your actual eyes, preferably in a public place. In the meantime, ask for the car’s details and look it up.

2. Report it to Facebook

As soon as you see the likes of a $7K 2015 Mazda, press the three little dots at the top right of the listing and report it as a scam.

First, this will feel good as an act of vengeance, but secondly, and more importantly, you’re potentially saving someone else from a lot of heartache.

The Facebook algorithms will also pick up on the theme, thus foiling the scammer’s tactic.

3. Recover your identity

Most of the online car sale scams are after your money, but there is an uneasiness knowing that your personal details are in the wrong hands, especially when it comes to a bank account.

A free, government-funded service such as iDcare can talk you through what to do if you get to that stage.

4. Contact your financial institution

If money has become involved, contact your bank as soon as possible. They can lock your account before further damage is done. This is crucial, given that with online scams, it is extremely unlikely for you to ever see your money again.

5. Report it to the authorities

The most obvious path is to call the local police. But you should also report it to the Australian Government’s ScamWatch and the Australian Cyber Security Centre (ACSC).

Obviously, in my case, it’s hard for an Argentinean to face consequences at the hands of the Australian justice system, but your report will be used by these departments to identify scam strategies and hot spots.

You can find more information about classified scams and where to get help on the ACCC ScamWatch website.