This house in Weston sold last weekend for $835,000. Weston dropped out of the million-dollar club during the decline in values sparked by interest rate rises. Photo: Zango.

Is your suburb still in the million-dollar club?

Fifteen of Canberra’s suburbs have dropped out of this exclusive gathering over the year to May as the Reserve Bank’s war on inflation drove up interest rates and drove down home values, opening up opportunities for some buyers who may have baulked at previous prices.

CoreLogic has surveyed Australia’s housing markets to pinpoint where median values have fallen below the magical million-dollar mark and found the percentage of Canberra suburbs still over a million has fallen from 41.5 per cent to 30 per cent.

This time last year, its Million Dollar Market report featured a record number of house and unit markets at the suburb level with a median value of $1 million or more, including 54 suburbs in Canberra.

One year and 12 interest rate rises later, membership of the million-dollar club has become more exclusive, with many of last year’s new entrants now falling below the million-dollar mark.

Between April 2022 and February 2023, CoreLogic’s national Home Value Index moved through the sharpest decline on record, falling 9.1 per cent in 10 months, with Canberra sliding 8.8 per cent.

While national dwelling values have recovered 2.3 per cent over the past three months, they remain 6.9 per cent below the recent peak, and Canberra only turned the corner last month for a marginal rebound of just 0.4 per cent.

As of May 2023, just 988 (22.3%) of the 4436 house and unit markets analysed nationally had a median value at or above $1 million, down from 1243 or 28.0 per cent this time last year.

CoreLogic Economist Kaytlin Ezzy said 237 house markets and 19 unit markets had median values fall below $1 million in the past year, while Burns Beach, a coastal suburb 34 kilometres north of Perth’s CBD, was the lone new entrant.

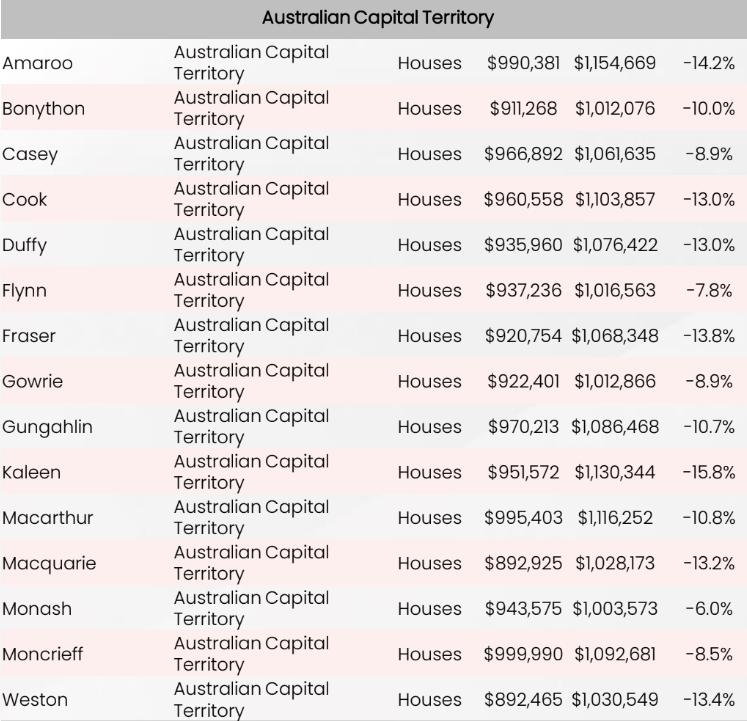

The 15 Canberra suburbs that have fallen out of the million-dollar club. Table: CoreLogic.

CoreLogic analysed 86 Canberra suburbs, finding 39 where the median house value remained in the club and 15 that had slipped out, mainly in outer areas such as Belconnen, Gungahlin, and Tuggeranong, although Weston in Weston Creek also lost its gold-plated status.

The biggest decline was in Kaleen, where the median house value dropped nearly 16 per cent from $1,130,344 to $951,572, while the smallest was Monash at -6 per cent ($1,003,573 to $943,575).

Moncrieff in Gungahlin only just failed to stay in the exclusive ranks at $999,990, down from $1,092,681, a fall of 8.5 per cent.

Weston, almost considered part of the desirable inner south these days, recorded the lowest median of $892,465, slipping from $1,030,549 or -13.4 per cent.

The Canberra median in May was $943,000.

Ms Ezzy said these 15 markets were concentrated in outer areas and more likely to have been recent entrants, unlike central Canberra, the inner south and north and Woden Valley, which held on to their million-dollar status.

Ms Ezzy said the 15 would probably rejoin the club but how long that would take would depend on the impact of further interest rates rises and supply.

Canberra house prices returned to the positive last month despite the May rate rise, but the surprisingly hot labour market pointed to the Reserve Bank hiking the cash rate in July and August, which will again put pressure on prices.

Ms Ezzy said a lack of supply and little choice in markets such as Sydney and Melbourne, where uncertain sellers were holding back, was behind the surge in prices there.

But total listings in Canberra this year had been relatively good, and while that had fallen off recently, numbers were still as would be expected at this time of the year.

“It really depends on if the prospect of the dampening of future interest rate rises will counteract that buoyancy of listings,” she said.

For buyers, it meant more relatively affordable areas to choose from, Ms Ezzy explained.

“Given the substantial decline in values, it is an opportunity for a lot of buyers to enter that market,” she said.

“But it’s important to remember that the downturn is off the back of a record level surge in values.”

Ms Ezzy said that while Canberra values had fallen about 10 per cent, they were still 25 per cent above where they were at the beginning of COVID, “so people are paying a lot more than they were just a couple of years ago”.

The other factor for buyers was how interest rate rises were eroding their borrowing capacity.

“People looking to enter the market may not be able to borrow as much as they could this time last year, which makes entry into that market even harder,” Ms Ezzy said.

No Canberra suburbs had a median value over $1 million for the unit and townhouse market. The Canberra median is just under $600,000.