Andrew Barr has proudly announced more of what he calls “affordable housing” in the Gungahlin suburb of Jacka:

The ACT Labor Government is committed to ensuring all Canberrans have access to affordable and appropriate housing, and this sale in the suburb of Jacka represents another success.

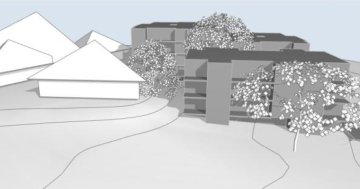

Jacka will see the construction of more than 200 new homes with more than 60 of them to be priced between $340,000 and $373,000.

The land, comprising two packaged lots for single dwellings and six multi-unit sites, sold for more than $11.4 million and was subject to a competitive tender process which attracted more than 30 bids.

The successful tenderers were the locally based Village Building Company, Gracious Living Constructions and Elevated Constructions Pty Ltd.

I am proud of the extensive work undertaken by this Government to address housing affordability.