The busier-than-usual winter property market provided a great starting point for the spring selling season, with the total number of listings and sales during September being higher than in 2013.

This flourish of activity has certainly given the market a ‘spring’ in its step, however it seems consumers are still feeling pessimistic.

Consumer confidence takes a dive

Despite interest rates remaining at a record low 2.5% for the 14th consecutive month, consumers are still erring on the side of caution.

Consumer Sentiment fell a whopping -4.6% in September to sit at 94, meaning almost all progress towards its recovery over the last 3 months have now been lost. The index now sits at just 1.1% above the post-Budget level.

Buyer & seller activity increased

Activity has been high and speedy during September. Buyer activity is up +13.5% annually, with 70 extra house sales taking place over the month. That’s an additional two properties sold every day!

1,772 properties have sold across ACT & Queanbeyan over the last quarter, representing an increase of +2.7% over the year and a modest +0.1% compared to the last quarter.

2,097 properties were listed to sell over the quarter, representing an increase of +1% annually.

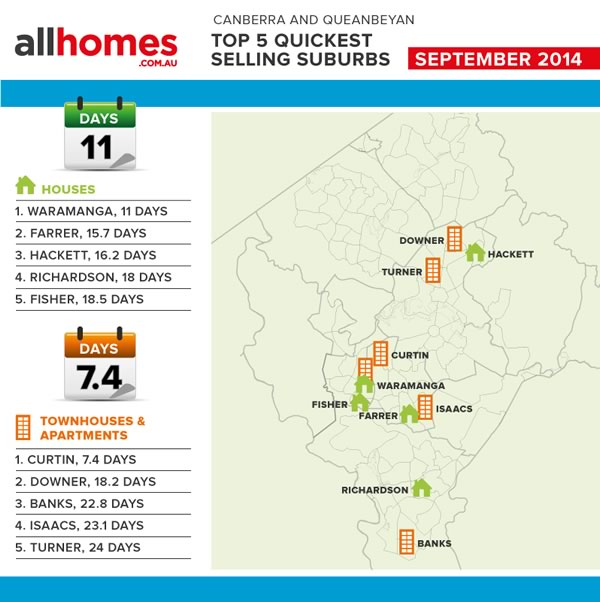

All property types are selling faster. Houses are spending an average of 69.1 days on the market, (3.9 days less than September 2013) while townhouses, units & apartments are on the market an average of 85.6 days (0.2 days less than September 2013).

Rental supply down while demand is up

It’s a superb time to be renting as median rental prices continue to drop, declining a further $5 in September to sit at $390 per week. This represents a -6% decline since September 2013 when the median weekly rent was $415.

Properties priced between $200- $400 per week have seen the most gain in the number of leases signed, whereas properties priced $400-$600 per week have suffered the largest fall.

Rental properties are now spending an average of 45.5 days on the market.

Comparing the September 2014 quarter to the same time last year, 334 fewer rental properties were listed while 194 more leases were signed.

If this trend continues, we might expect the stubborn decline in median rental prices to ease and the market to gain momentum once more.

Other key information