New apartment stock is pushing prices down and providing the best entry points for buyers. Photo: Ian Bushnell.

Canberra’s housing market marked time in July, delivering a flat result as the mid-winter chill gripped the national capital.

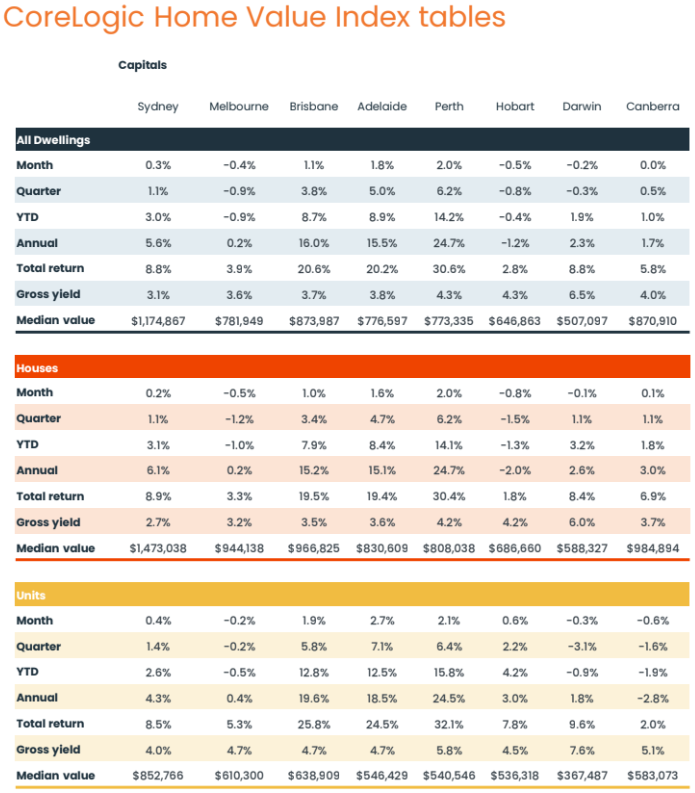

According to CoreLogic’s home value index, the only movement was another slight fall in unit prices taking the decrease for the past 12 months to almost -3 per cent.

That’s the result of plenty of new stock around for buyers to choose from.

The median value for a unit or townhouse is now $583,000, the fourth highest in the country after Sydney, Brisbane and Melbourne.

Overall, Canberra’s home prices are now the third-highest in the country after Sydney and Brisbane, which have stormed past as a lack of supply put a fire under the market.

House prices barely moved with a 0.1 per cent rise, but for the year, they have gone the other way for units and townhouses, up 3 per cent.

The median house price is now almost $985,000, which is still the second highest behind Sydney, although Brisbane is catching up and has overtaken Melbourne, where prices fell by 0.5 per cent in July.

Wednesday’s underlying inflation result, which continued a declining trend, offered hope that the Reserve Bank would not lift interest rates and that a cut might again be in the offing down the track.

CoreLogic research director Tim Lawless said that while housing was a big contributor to inflation, that was mainly in the form of rents, and those rises were also moderating.

“The good news is interest rates won’t be going up and the next movement will be going down, who knows when,” he said.

Overall, Canberra home prices are now the third-highest in the country after Sydney and Brisbane. Table: CoreLogic.

Mr Lawless said Canberra remained a bit of an outlier with relatively high affordability after adjusting for local incomes and a bountiful supply of high and medium-density dwellings.

Meanwhile, in the other capitals, an erosion in borrowing capacity and affordability factors was skewing demand towards the lower price points of the market, and demand remained strong in Canberra’s upper quartile.

That can be seen in the $2.15 million sale of a three-bedroom, three-bathroom sub-penthouse in the Sapphire complex in Kingston Foreshore last weekend.

Mr Lawless said the key feature of Canberra’s market was the difference in prices between houses and units.

“It’s a real demonstration of what happens to housing prices when there’s a reasonably sufficient supply response,” he said.

“The Canberra unit market has had a lot of new developments over the past decade or so, with nearly three times more apartments built than houses.”

He said the units-intensive and outer fringe greenfield areas were the softest parts of the market.

Mr Lawless said house prices were generally rising, although it’s a subtle trend.

He said any surge in detached house construction would have to be large to have the same impact on prices as the apartment boom.

“If we did see a turnaround it would probably take quite a while to get the stimulation of supply seen in the units sector,” Mr Lawless said.

It also could take longer due to the underlying demand for detached housing.

Mr Lawless said the increase in investor activity seen elsewhere in Australia was not apparent in Canberra.

Nationally, the number of investor loans is up 24.8 per cent on last year, and the value of lending to investors has jumped 29.5 per cent over the year to comprise 37.1 per cent of mortgage demand.

Much of this is directed at the boom states of WA and Queensland, where capital gains are the greatest.

Mr Lawless doubted ACT tenancy reforms had had much impact.

“Investor demand is much more related to credit availability and the rate of capital gain,” he said.

“Rental yields tend to be an afterthought. They can negatively gear, and capital growth is the be-all and end-all for investors.”

Historically, there had not been a lot of disruption to investment during a period of tenancy reform, Mr Lawless said.

Nationally the market is divided between the boom cities of Perth, Adelaide and Brisbane and the rest where prices are falling or rises moderating.

CoreLogic says a mismatch of supply and demand remains, but there are signs that a rebalancing is underway with above-average listings coming onto the market.