Apartment prices have been trending down for the past seven months. Photo: Michelle Kroll.

If you’re thinking about buying an apartment in Canberra, now is as good a time as ever.

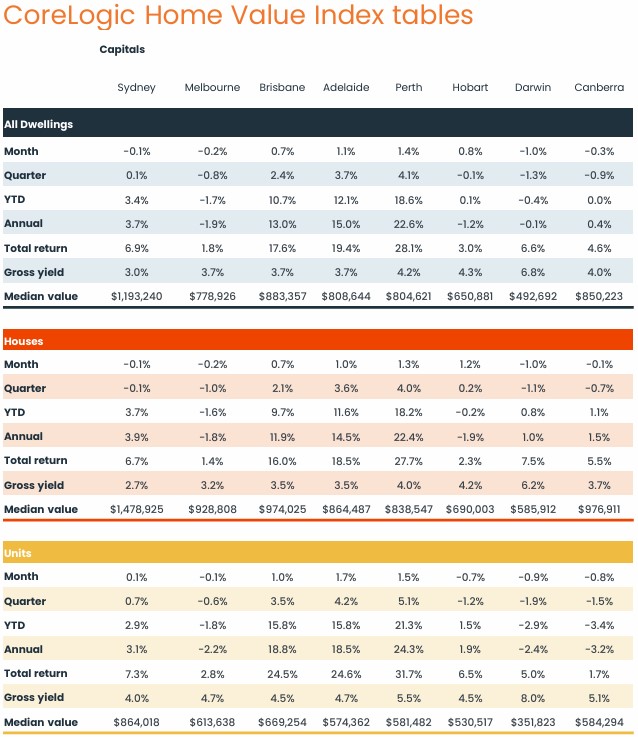

The latest monthly CoreLogic Home Value Index shows apartment prices have been falling for about the past seven months.

In October, they fell a further -0.8 per cent. That’s -3.4 per cent for the year, bringing the median value to $584,000.

That contrasts with houses, which are in the black for 2024, rising 1.1 per cent, although, over the last quarter, there was a slight dip of -0.7 per cent, for a median of $976,000.

Across all property types, it’s the fourth month in a row where prices have fallen, albeit modestly.

CoreLogic research director Tim Lawless said it appeared that Canberra was moving into a reasonably shallow downturn, mostly led by the unit sector, where there was a higher supply of properties.

“It’s probably a good opportunity for people who are looking to get into the apartment market,” he said.

“It’s certainly showing a pretty affordable price point.”

It appeared that Canberra was moving into a reasonably shallow downturn, mostly led by the unit sector. Table: CoreLogic.

Price trends varied across the ACT in October, with only a flat Gungahlin and Molonglo (+0.9%) avoiding a fall and everywhere else down slightly.

Over the last 12 months, prices rose in Tuggeranong (2.1%), Belconnen (1.6%), Molonglo (0.8%), North Canberra (0.7%), and Woden Valley (0.5%), while South Canberra (-0.8%), Gungahlin (-1.8%) and Weston Creek (-2.1%) were in the red.

But Mr Lawless said that while there was diversity across the districts, this was not a big range.

“Broadly speaking, even the markets that are in decline aren’t falling precipitously,” he said.

The low number of building approvals would likely continue to put a floor under prices.

Mr Lawless said Canberra was enjoying its annual spring surge of properties onto the market, providing more choice for buyers, but listings were down 18 per cent on the same time last year and tracking about 11 per cent below the five-year average total listing.

“It’s been ramping up solidly but in line with the typical seasonal pattern,” he said.

“But when you look at the actual magnitude, even though we’re seeing an upward trend in new listings coming to the market, it’s quite a bit less than what we saw last year.”

There were no signs of signs of a dumping of stock onto the market or a rush to get out of the market.

The Property Collective’s Director of Sales and Projects, Will Honey, said the market remained patchy, but spring had brought buyers out, mainly looking for well-priced, well-presented properties across all types that did not need much work.

With a lot of choices at present, buyers are selective when it comes to things such as location and maintenance.

Mr Honey said the buying opportunities in apartments were mainly in the second-hand market, as well as in the growing one-bedroom sector.

He said mortgage brokers were reporting a strong increase in pre-approvals for clients in October, pointing to greater confidence in the market.

“Buyers are going to get approvals because they think now it’s probably starting to be the time that they should go and look,” Mr Honey said.

“I don’t know if that’s because people feel like the bottom of the market is here and better times are ahead, but it’s definitely got that feel about it.”

Both Mr Lawless and Mr Honey welcomed this week’s encouraging inflation figures but were cautious about the prospect of an interest rate cut any time soon, saying the Reserve Bank would probably wait until next year.