Housing prices in Canberra have skyrocketed since 2000. Photo: Michelle Kroll.

In 1975, the average price of a home in Canberra was $33,600. This was higher than Melbourne’s average and on par with Sydney.

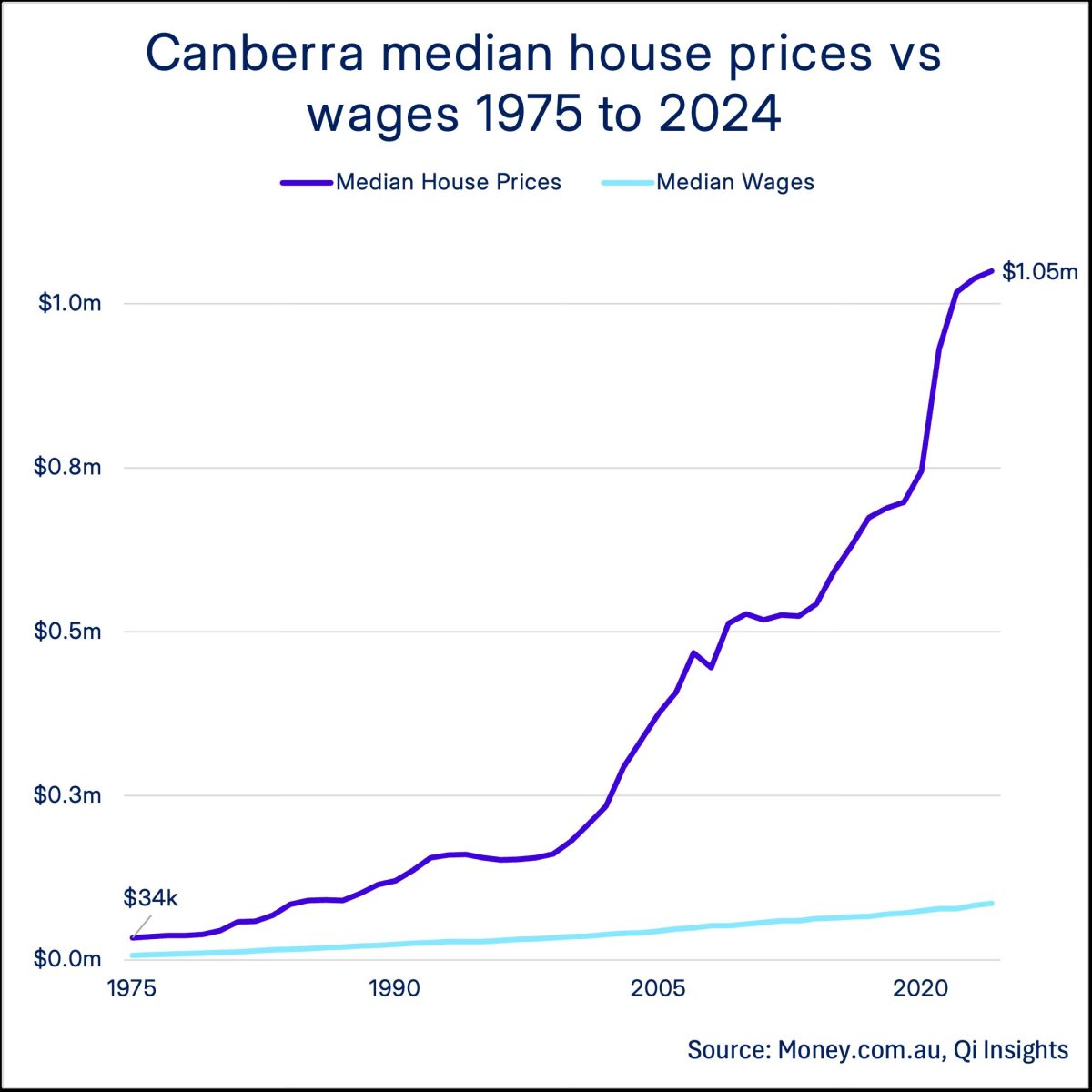

Analysis from money.com.au shows Canberra’s average price has gone up 3024 per cent since then, a slower rate than both Sydney and Melbourne but enough to torpedo affordability for the typical worker.

The median house price in the ACT is now $1,049,719 – about 12 times the median annual income, compared to just five times 50 years ago.

Growth in Canberra house prices was fairly steady between 1975 and 1999, but they have skyrocketed since the turn of the century.

Canberra house prices are rising much faster than average incomes. Chart: money.com.au.

“Once affordable and largely tied to public service jobs, Canberra’s property values began to climb in the 2000s as the city grew and attracted more people,” money.com.au property expert Mansour Soltani said.

“Limited land releases, stable employment, and steady migration have all contributed to rising prices. Population growth and government investments have kept demand strong, making Canberra one of Australia’s most resilient markets.”

Matt Grudnoff, an economist at think tank the Australia Institute, says there’s another reason for the sharp growth since 2000.

“The capital gains tax discount was introduced [by the Howard Government] in September 1999. I don’t think that’s a coincidence,” he said.

Capital gains tax is paid on the profit you make when you sell an asset that has increased in value.

The discount offered since 1999 means that if you buy an asset (such as a house), hold it for 12 months, and then sell it, you only pay tax on half the profit you made.

“We’ve always had immigration and land releases issues, I don’t think any of that dramatically changed after 2000,” Mr Grudnoff said.

“But after the capital gains tax discount was brought in, negative gearing radically increased and investors rushed into the market. That was the dominant cause of rising prices. Investors increasingly have been entering the market. They’re usually buying their second, third, 10th or 100th house. They’ve got better access to wealth and credit. They have bid up the cost of housing.”

Mr Grudnoff says this explains the rising prices in all our capital cities. He says the best way to make housing more affordable is to get rid of the capital gains tax discount and negative gearing and to build more public housing to increase supply.

Money.com.au data expert Peter Drennan had a different explanation as to why the rate of growth appears to have increased in Canberra since 2000.

“Growth in Melbourne and Canberra has followed a relatively similar trajectory. In 1975, Canberra’s median price was significantly higher than Melbourne’s and more closely aligned with Sydney. Melbourne caught up in the 1980s, and prices have remained relatively similar since. The initially lower median price in Melbourne explains its higher overall growth rate,” he said.

“Between 1975 and 2000, prices in Canberra rose by nearly 500 per cent. They have increased by almost 500 per cent again since then; however, as prices rise, a 500 per cent increase equates to a much larger dollar amount, which appears as acceleration on the chart.”

Money.com.au data shows house prices in Sydney have increased by 4645 per cent since 1974 and are now 19 times the median income.

House prices in Brisbane, Melbourne, Adelaide and Perth have also grown at a faster rate than Canberra over the past half century, with Hobart the only capital city in which prices are growing at a slower rate.