Demand for houses continues to drive the market. Photo: File.

Canberra home prices rose another 2 per cent in February amid a rush to buy into a market in full gallop.

CoreLogic says Australia’s home prices are rising month-to-month faster than at any time in the last 17 years, spurred on by a combination of record-low mortgage rates, improving economic conditions, government incentives and low advertised supply levels.

In Canberra, the last three weekends have produced clearance rates above 80 per cent and increasing median sales figures.

In a sign that the record results may tempt more owners, 79 properties were listed last weekend for action, compared with 55 and 48 the previous two weekends. The clearance rate was 84 per cent and the median sales result was nearly a million dollars.

Over the past three weekends, the median sale price has gone from $800,000 to $910,000. Leading the top 10 was a four-bedroom house in Deakin that went for $2.7 million, while in 10th place a four-bedroom house in Dickson sold for $1,430,000.

Most of the top 10 were in the Inner South and North, apart from a six-bedroom house in Nicholls in Gungahlin that brought $2,021,000.

Overall, most of the properties were houses with a smattering of townhouses and terraces.

The cheapest home was a two-bedroom townhouse that sold for $461,000.

Houses are driving the Canberra market, rising 2.2 per cent in February for a median value of $797,421.

Units rose as well, but only a modest 0.7 per cent for a median value of $479,943. Overall the median dwelling value is $706,454.

Over the 12 months, house prices have risen 11 per cent, and units more than half of that at 5.2 per cent.

The booming market coincides with record loan approvals for new builds, driven by the Federal Government’s HomeBuilder grant.

The latest lending data from the ABS shows the number of loans to Canberra owner-occupiers for constructing new dwellings in the three months to January 2021 compared to the same time last year rose 87.4 per cent.

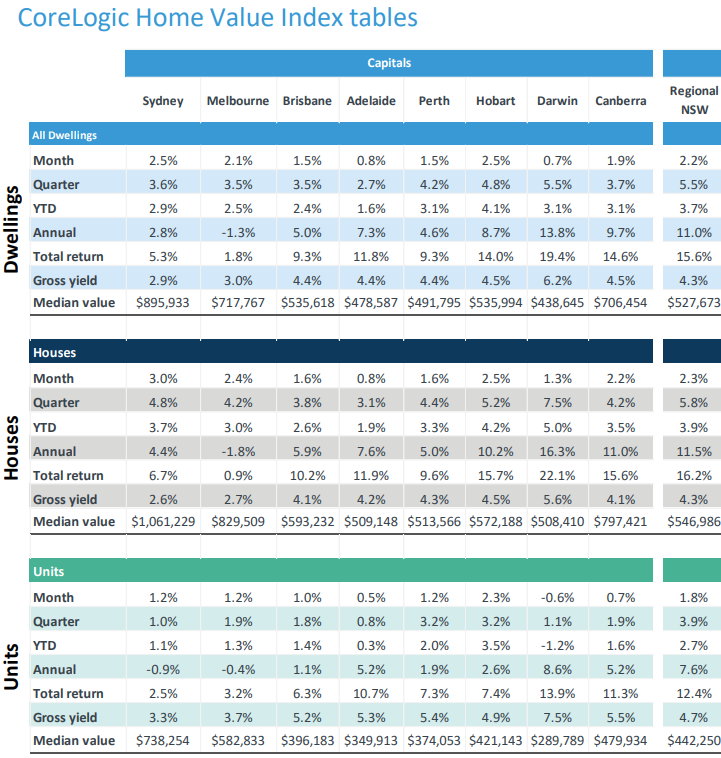

National CoreLogic Home Value Index tables. Image: CoreLogic.

Housing Industry Association economist Angela Lillicrap said the increase in lending in January coincided with the surge seen in HIA’s New Home Sales in December.

“Households rushed to finalise contracts to build a new home before the end of the 31 December 2020 deadline to access the $25,000 grant,” she said.

“The number of construction loans to owner-occupiers in the three months to January 2021 is 45.8 per cent higher than the previous quarter and is more than double the same time the previous year.”

She said low-interest rates, rising house prices, higher savings and a demographic shift in demand towards detached housing and regional areas should ensure ongoing demand for new homes into 2021.

CoreLogic says housing values are rising across each of the capital cities and the rest of state regions, demonstrating the diverse nature of this upswing.

Research director Tim Lawless said a synchronised growth phase like this hadn’t been seen in Australia for more than a decade.

“The last time we saw a sustained period where every capital city and rest of state region was rising in value was mid-2009 through to early 2010, as post-GFC stimulus fueled buyer demand,” he said.

One of the factors driving housing prices higher is low advertised supply levels. The number of properties advertised for sale nationally remains 26.2 per cent below 2020 levels over the 28 days ending 21 February.

CoreLogic’s estimate of settled house sales rose to be 17.9 per cent above the decade average over the past six months. Settled unit sales have also trended higher but remain slightly below the decade average (-0.8%), reflecting the falling demand for higher density styles of properties.

“Buyers are likely confronting a sense of FOMO [fear of missing out] which limits their ability to negotiate,” Mr Lawless said.

But new listing numbers could lift in March, with CoreLogic’s real estate platform data indicating agents are becoming more active.

“Although new listings are likely to track higher over coming months if buyer demand continues to lift, it’s likely overall advertised stock levels will remain low,” Mr Lawless said.

“Serious buyers would be well advised to have their financing preapproved and be ready to act fast to secure a property under such tight supply conditions.”