Canberra is the best performing capital city market in the country.

Canberra’s home values have finally yielded to the pressures on the national housing market, with prices dipping for the first time in a long time last month, by 0.2 per cent.

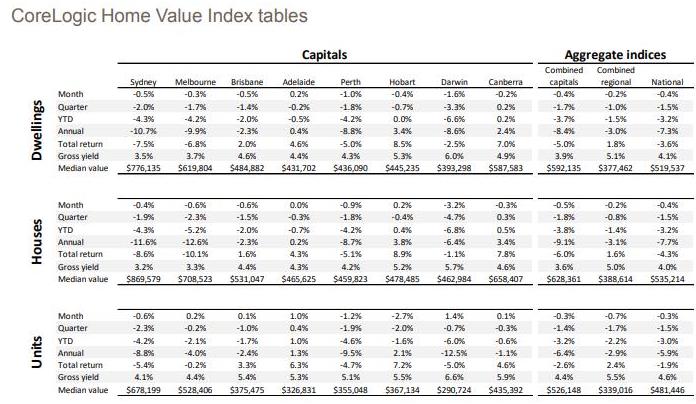

But according to Core Logic, the Canberra market is still the best performing capital city in the nation, with the median dwelling price now $587,583, still up marginally over the three months up to 31 May at 0.2 per cent and 2.4 per cent over the 12 months.

Houses, which have been particularly resilient, fell more than units, down 0.3 per cent on last month but are still up 0.3 per cent over the quarter and 0.5 per cent so far this year, while over the 12 months values rose 3.4 per cent. The median price is $658,407.

Units, with a median price of $435,392, remained more or less steady improving only 0.1 per cent last month, but being down 0.3 per cent over the quarter and 0.6 per cent so far this year. Over the 12 months to 31 May the price of units has fallen 1.1 per cent.

But the national capital has been a boon for owner-occupiers and investors over the past five years, with Canberra’s overall dwelling values rising 23.5 per cent.

Ironically, the softness in the resilient Canberra market comes as prices in the big Sydney and Melbourne markets have started to arrest their falls, if not bouncing back.

Core Logic says that although dwelling values are still trending lower across Australia, the pace of declines eased further in May, continuing a trend that has been evident since the beginning of 2019.

Nationally, dwelling values were down 0.4 per cent in May, which was the smallest month-on-month decline since May 2018.

“This improvement is primarily being driven by a slower rate of decline in Sydney and Melbourne where housing values were previously falling at the fastest rate of any capital city. Sydney values were 0.5 per cent lower

over the month while Melbourne values were 0.3 per cent lower; the smallest decline in values across both cities since March last year,” Core Logic’s Tim Lawless says.

“In other cities, where housing market conditions have generally been more resilient to a downturn, the trend is opposite.”

“Hobart values have tracked lower for two months running, taking the rolling quarterly rate of change into negative territory for the first time since early 2016, and with Canberra values 0.2 per cent lower over the month, the quarterly rate of growth remains only slightly in positive territory (+0.2 per cent).

Mr Lawless says the outlook is more positive after the election result removed uncertainty about taxation policies and the likelihood of lower interest rates, along with an easing of loan serviceability tests.

But he says lenders are still making it tougher for borrowers in the wake of the banking royal commission and are keen to reduce their exposure.

“Although interest rates and serviceability tests are set to reduce, lenders are continuing to scrutinise incomes and expenses much more intensely,” he says.

Comprehensive credit reporting is providing lenders with greater visibility around borrower finances and overall debt levels, and progressively lenders are reducing their exposure to borrowers with high debt levels relative to their income.”