Canberra rents for apartments are the steepest in the country. Photo: Michelle Kroll.

Canberra’s rental crisis is deepening at a time when there is usually some recovery from the beginning of the year influx of new workers and students, and there are industry warnings that the situation is only going to get worse.

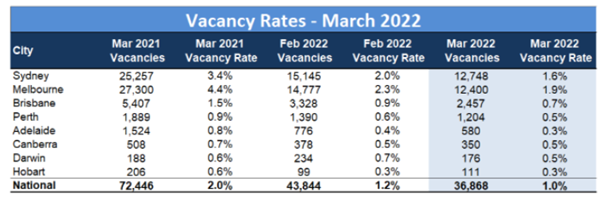

The latest data from SQM Research shows the ACT’s vacancy rate in March unmoved at a suffocating 0.5 per cent, and the number of vacant properties falling slightly. Rents continue to rise, particularly for apartments.

At the same time last year there were about 500 vacancies; this March they are down to just 350 – 28 fewer than in February.

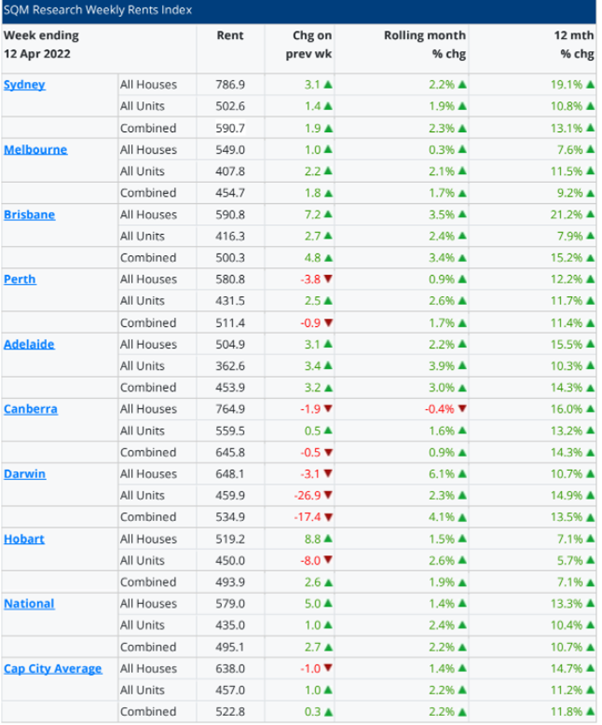

In the past 12 months house rents have soared 16 per cent, and apartments 13.2 per cent. Over the past month, rents for houses dipped slightly (0.4 per cent) but the average rent is $765 a week. Rents for apartments rose 1.6 per cent with the average rent now $560 a week, the highest in the country.

The combined average rent in the ACT at $645 is also the highest in the country.

Real Estate Institute ACT President and Director of Property Management for The Property Collective, Hannah Gill said people were still coming into Canberra to take up work, mostly with government, and that was likely to increase in coming months after the Budget unveiled plans to boost the size of the Australian Defence Force, and Defence and security spending generally.

Compounding the situation is the imminent return of more international students to Canberra.

“In the last week I dealt with a lot of Defence and DFAT tenants,” Ms Gills said.

“We’ve already got significantly low supply, rents are going up, people aren’t inclined to be moving to pay more, and then you’re adding extra people to the market. It’s only going to get worse before it gets better.”

Ms Gill said there was also no affordability in the market at all, and more and more people were forking out more of their income on rent.

She said the income to rent ratios were worsening, pushing many tenants into rental stress.

“We try to have tenants contributing no more than 30 per cent of their annual income,” Ms Gill said.

“What’s interesting is that for more and more, even with multiple occupants, the average ratio is now in the 30s. People are having to put more of their income towards the rent because there is no alternative.

“We’re getting 35 to 40 per cent ratios in properties you’d previously expect to have a 20 to 25 per cent ratio.”

While open homes have settled down somewhat after the “madness” of January, Ms Gill was still seeing very strong demand with groups of five to 10 people inspecting properties.

Houses remain in demand but there are just too few of them, and Ms Gill said investors were continuing to bail out of the market and realise their massive capital gains in the face of increasing costs. Those properties were going to owner occupiers or developers.

Ms Gill said investors blame legislative changes, land tax and the looming impact of having to meet minimum energy efficiency standards,

“Investors say they can’t afford 30 to 40 grand to reach minimum standards, they’re going to get out while the market is hot,” she said.

“Ultimately, when you’re talking about older houses in Canberra, the cost to bring these up to a minimum standard from an energy efficiency perspective could be tens of thousands of dollars – your typical mum and dad investor just doesn’t have that kind of money lying around.”

The only solution is a dramatic increase in supply but Ms Gill said there was no relief in sight in the short term.

The national rental market is also worsening, with tighter vacancy rates and exploding rents.

Managing Director of SQM Research, Louis Christopher said the data suggested Australia was still not at the worst point of the crisis.

“We were thinking at least regional Australia may have started to have some relief as people return back to the cities but that has not happened as yet. Many localities and townships are recording zero vacancy rates,” he said.

“It is likely homelessness will be increasing in this environment.”

But he said there was dearth of specific policy in the election campaign to deal with the issues surrounding housing affordability.

“Clearly, we are not going to resolve this overnight, but I do hope the various state and territory governments will ramp up their rental assistance packages in order to cushion the rental accommodation emergency we have here and now.”