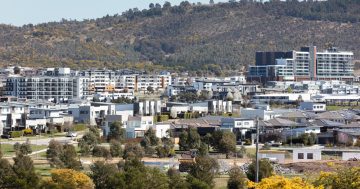

The Canberra property industry expects the rate cut to bring both buyers and sellers back into the market. Photo: Michelle Kroll.

Tuesday’s interest rate cut was no big deal, asserted many commentators. Try telling that to potential home buyers who have flooded mortgage brokers since Reserve Bank Governor Michelle Bullock finally relented after 13 increases and 18 months of holding rates steady.

Clarity Home Loans director Rob Garth said the emails started coming in at 2:30 pm on Tuesday as the 0.25 per cent trim sunk in.

“There was a heap of emails, and then overnight, and then a heap of phone calls, people reaching out seeing how it impacts them,” he said.

“The good thing is that most banks are just going to automatically pass it on.”

“There’s no one come out yet to say that they’re not passing it on in full.”

Mr Garth said the cut was a relief for households, but for those waiting to enter the market, it would mean a boost to borrowing capacity of between $10,000 and $20,000 and their repayment ability, although buyers were more conservative about stretching their budget.

While the announcement triggered an immediate response, Mr Garth said the mood in Canberra had already shifted from about spring last year when it became apparent that rates were at least not going to rise.

“We started seeing more inquiries probably as early as August and September last year,” Mr Garth said.

“I think most people had already anticipated that rates at least weren’t going up and, if anything, were going to be on hold or there was a potential rate cut to come.

“So I think Canberra’s probably already had a bit of an uptick in inquiry.”

Mr Garth said a couple more cuts would be welcome, but this one might be enough to get some people across the line.

Canberra’s market, with a solid supply of properties, cooled last year while other capitals still experienced growth in prices, so Mr Garth expects the rate cut to bring more buyers into play, including investors, who have been out of action for some time.

First-home buyers made up about half of Clarity’s clientele, with many using the Federal Government’s First Home Guarantee.

“That’s the people looking to get ready for later in the year or people that are ready to go straight away,” he said.

Borrowers were looking at a cross-section of properties, with some looking to upgrade from units and townhouses into houses, and some couples looking to go straight into a home.

“Single borrowers are generally looking at units and townhouses just because they are less of a stretch on the single income,” Mr Garth said.

“We’re probably seeing a good mix of dwellings being chased, and we’re seeing a few more investors coming back in and wanting to look at borrowing capacity and looking at the market picking back up.”

The Property Collective’s Will Honey said the rate cut had buoyed the Canberra property industry despite its size and Ms Bullock’s warning not to expect another one anytime soon.

Mr Honey said brokers had told him the response had been immediate, also confirming that pre-approvals had been up since late last year.

He said that was usually the first domino to fall.

“I reckon there’ll be more buyers entering the market for sure,” Mr Honey said.

This new buyer interest would absorb a lot of the properties that had boosted supply and given buyers more choice, but it would also entice owners who had been holding off listing their properties.

But Mr Honey was not expecting a rush on the market.

“I don’t see anything too crazy,” he said. “I think it’ll be a nice little kick of confidence and then things might settle down.”

One rate cut might not be enough for developers to pull the trigger on land they were sitting on, but a couple more would mean the numbers start to increase.

Mr Honey said the Canberra market could be headed for a bumper spring selling season if those further rate cuts materialise.