Not enough: constrained supply and rising demand will boost prices to June 2025. Photo: Michelle Kroll.

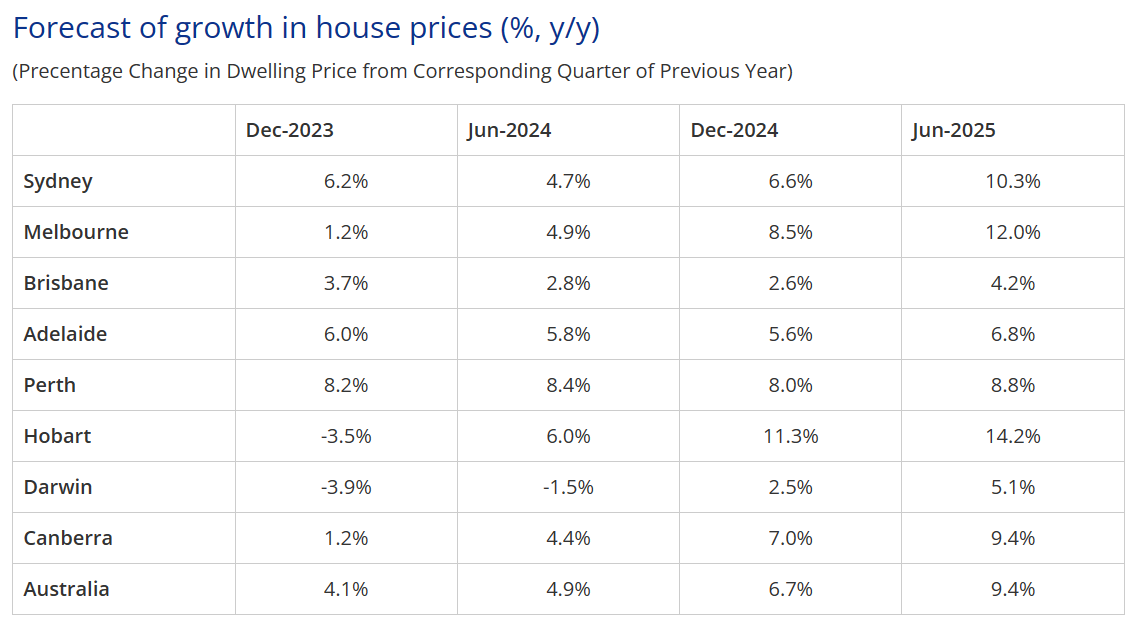

Canberra house prices will pick up over the next nine months to rise by 4.4 per cent and then surge by nearly 10 per cent by the end of the 2025 financial year, according to the latest property report from KPMG.

It may be good news for owners, but for those trying to enter the market, the prediction of another spike in prices after the COVID era boom will be cause for despair.

The forecast rise in Canberra real estate mirrors the national trend predicted for standalone properties and will only strengthen the move towards units and townhouses, especially as the KPMG report sees that sector only experiencing moderate increases in price.

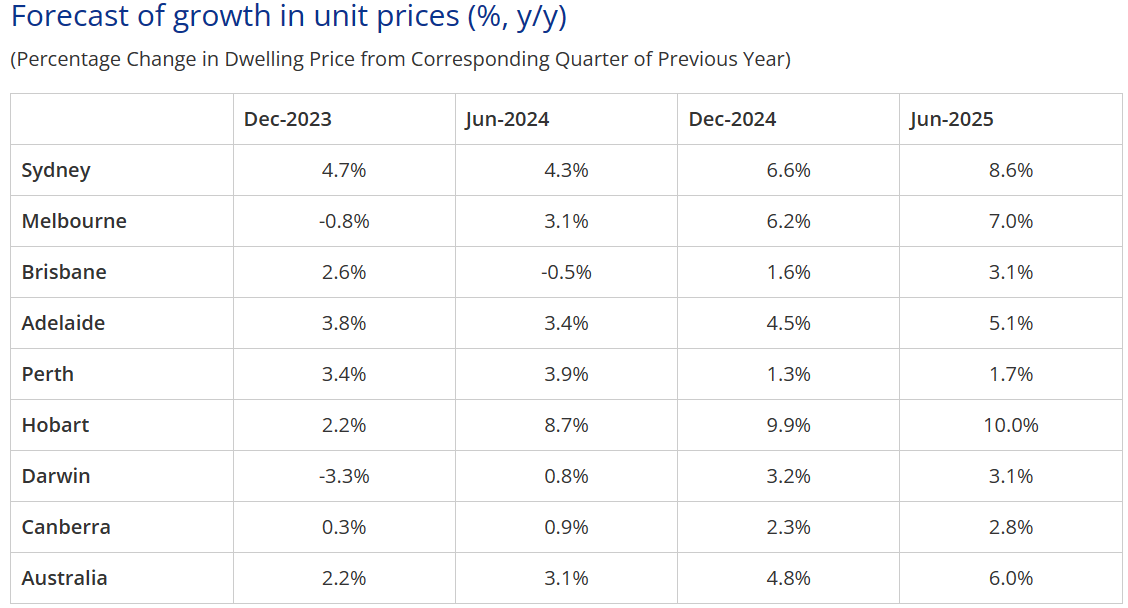

By June 2024, units are expected to only rise 0.9 per cent, and by the end of the 2025 financial year by 2.8 per cent, well below the national figures of 3.1 per cent and 6 per cent.

Canberra rises echo the national average, according to KPMG. Table: KPMG.

KPMG says it all comes down to insufficient supply and increasing demand, particularly rising migration, a combination that will outweigh relatively high interest rates, especially as the end of the tightening cycle may be in sight and rates could fall.

Rising rents will also feed into demand as tenants look to break out of the rent trap and become homeowners.

The report says there will be regional differences reflected in the fact that Perth and Adelaide will lead the way initially, but by the end of June 2025, Sydney (10.3%), Melbourne (12%) and Canberra (9.4%) will resume their roles as the top three markets in the country from a house price growth perspective.

But according to KPMG, unit prices in the national capital will not keep up with Sydney (8.6%), Melbourne (7%), and leader Hobart at 10 per cent.

This may be because of a reasonable pipeline in the short term and that prices already have a solid base. Since March 2020, Canberra units have risen in value by 25 per cent compared to much less in the two big capitals.

KPMG Chief Economist Dr Brendan Rynne said constrained supply was the dominant factor influencing property prices in the short term and would result in continued price gains in most markets during financial year 2024.

“House and unit prices will then accelerate further in the next financial year as dwelling supply continues to be limited due to scarcity of available land, falling levels of approvals and slower or more costly construction activity,” he said.

Then there is the coming migrant boom, with this year’s Budget projecting a net gain of 400,000 and 340,000 to Australia’s population through overseas migration this year and the next, respectively.

Canberra unit price rises are well below the forecast average. Table: KPMG.

Dr Rynne said other factors were anticipated rate cuts moving into financial year 2025, and potentially relaxed lending conditions; high rental costs pushing renters to look to buy instead; barriers to developers building new homes; foreign investor demand picking up again; along with the longer post-pandemic demand for more space as people continue to work from home.

Mortgage stress and the effects of 1.3 million households coming off fixed-rate mortgages over the next two years will provide some drag, “but on balance, the factors pushing prices up will more than counter those restraining them”, Dr Rynne said.

The report outlines that rising rental costs can significantly push up dwelling prices as more renters try for home ownership.

“Based on our projections for new dwelling completions and the Treasury’s population forecasts, we estimate that annual rent growth will be 5.6 per cent over the next two years – which is 2.5 per cent higher than the long-term average of 3.1 per cent,” Dr Rynne said.

“We assess that dwelling completions would have to be around 76 per cent higher than is currently forecast for those rental costs to be pulled back to normal levels.

“Either that or population growth from migration would have to be brought down to considerably lower levels than at present – which would mean short-term costs overriding long-term economic benefits.”