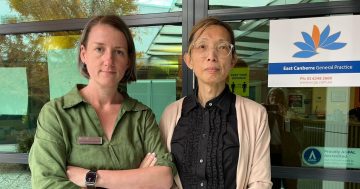

Whizdom CEO John McCluskey says sudden changes to the new payroll tax surcharge rollout can have unintended consequences. Photo: Thomas Lucraft.

An unexpected change to the rollout of the ACT’s new payroll tax surcharges has far-reaching implications for local businesses and contractors, according to a Canberra recruitment expert.

Whizdom managing director John McCluskey said payroll tax had until recently been 6.85 per cent applied to all ACT taxable wages above the payroll tax threshold. It was originally earmarked for a 0.25 per cent surcharge applied to businesses with Australia-wide wages above $50 million per annum in the 25/26 financial year and a 0.5 per cent surcharge for businesses with Australia-wide wages above $100 million per annum in the following year.

Instead, those surcharges were brought forward by 12 months with “only a few days’ notice” – a sudden acceleration that would require a business with wages of $100 million to cough up an extra $500,000.

John said the change had left in the lurch businesses and contractors already grappling with a challenging economic environment.

“We knew it was coming, and we had negotiated our contracts coming up to the end of June 30 with the understanding the payroll tax would remain at 6.85 per cent until the 25/26 financial year,” he said.

“On June 26, after we’d gotten through the end of our financial year processes and negotiations and the contracts were signed, they told us those changes would come into effect from June 30 this year.

“With only four days’ notice, we couldn’t renegotiate existing contracts, which we’re bound for 12 months.”

John said had the industry known, it could have been better prepared by passing on at least some of the costs.

“We wouldn’t pass them all on – everyone is struggling after all. But while these increases may not seem significant, you have to bear in mind recruitment companies tend to work on margins of about 10 per cent. After on-costs, the profit margins are about three per cent,” he said.

ACT’s base payroll tax of 6.85 per cent before the surcharge is already the highest in the nation, followed by Northern Territory and Western Australia (5.5 per cent) and NSW (5.45 per cent). All other states sit below 5 per cent.

Its exemption threshold of $2 million is also the highest in the country.

John said bringing forward the payroll tax surcharges felt punitive for bigger businesses and exacerbated conditions that already presented challenges for the Capital’s businesses to compete on a national level.

“Our businesses are already looking at a 2 per cent disadvantage when compared to other states,” he said.

“The ACT already has the highest rate of business failure in the country per capita, and this isn’t doing anything to help.”

John said the surcharge may yield unintended consequences to the ACT employment rates and economy, such as businesses opting to employ people in jurisdictions with more favourable payroll conditions.

He said the move was likely related to the significant downturn in business stemming from the government’s reduced reliance on contractors.

“We have seen a reduction in the opportunities in our industry to provide candidates to the government and private clients here … We’ve seen several people close shop or move out of the ACT as a result of worsening conditions,” he said.

“Whizdom has picked up a few people from local businesses who have downsized or closed shop in the ACT, and a lot of people are considering whether the Canberra market is a place they want to do business.

“I’ve been around a long time and I’ve seen the cycles. But the recruitment industry is the canary in the coal mine for the economy. We’re in the business of providing employees to businesses, and when we slow down, it’s saying something.”

While lobbying recently won recruitment and labour-hire businesses a three-month grace period, John called for the government to hold true to its original timeline.

“We need the time we were promised to put our strategies in place. You can’t cater for a change this significant with four days’ notice,” he said.

“It also stymies growth. The government won’t be able to collect any payroll tax if they’re going to keep going after companies that do hit the $2 million threshold because businesses will simply make other arrangements to avoid that.

“Whizdom is considered a big business by the government definition, but we’re still a Canberra business, and it took us 20 years to build up to this stage. Big business is not bad for Canberra – we need that investment for employment.

“We want growth, we want companies to pay tax – the more we help local business thrive, the better off the economy is.”