Canberra home values, and houses in particular, continue to stay solid. Photo: Region Media.

The number of properties on the market in April may have fallen away but the coronavirus restrictions have failed to dent Canberra’s house values.

The latest data from CoreLogic reveals a resilient housing market across the nation despite a sharp drop in activity.

CoreLogic head of research Tim Lawless says that, ironically, the fall in listings seems to have insulated the market so far from feared big drops in values.

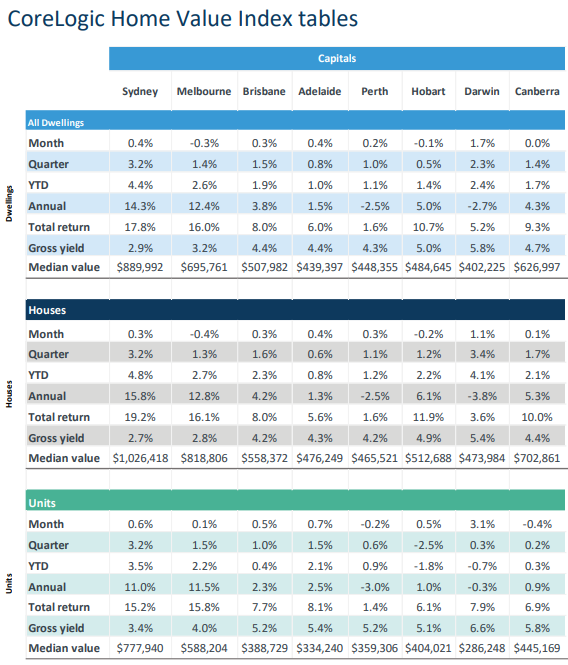

In Canberra, house values stood their ground as the auctions list was reduced to virtual affairs, rising only 0.1 per cent but retaining a 1.7 per cent quarterly gain for the median house value to stay above $700,000.

Ninety-two properties were listed for auction on Saturday, 4 April but two weeks later that had fallen to just 29, although it included a million-dollar-plus suburb record for Bonython.

Overall, houses and units combined were flat, with a 1.4 percent rise for the quarter and a median home value of $626,997, still the third-highest in the country after Sydney and Melbourne.

Unit values fell 0.4 per cent for a median value of $445,169, which is basically a flat result for the quarter and the year.

The data confirms agents’ views that Canberra’s strong public sector employment base will sustain the market and that people active in the market are genuine, pre-approved buyers.

In Canberra, house values stood their ground as the auctions list was reduced to virtual affairs. Image: CoreLogic.

But Canberra’s results mirrored a national slowing in the pace of growth, which halved in April and was the smallest month-on-month movement since June last year.

CoreLogic also estimates settled sales plunged by around 40 per cent in April as buyers retreated to the sidelines and listing numbers dried up.

But Mr Lawless says the April result looks remarkably resilient, and the nation’s success in stopping the spread of the virus offers hope that social distancing measures may be wound back further.

“The good news is that Australia has managed to flatten the spread of the virus more effectively and efficiently than expected and we are already seeing a subtle easing of social distancing policies in some states,” he said.

“An early return of economic activity should support a lift in consumer spirits which in turn should see housing market activity sparking back to life.”

A key factor in this market resiliency is the leniency banks have provided to distressed borrowers affected by COVID-19, including payment holidays.

Mr Lawless says that the high rate of unemployment is also more likely to impact workers that have lower rates of homeownership, while the unprecedented level of stimulus is keeping businesses and their staff afloat.