Wanted: more freestanding homes for sale. Canberra’s market cannot get enough. Photo: File.

Canberra’s record house values have again surged as cashed-up spring buyers snap up any available stock and government incentives spur interest in new home builds.

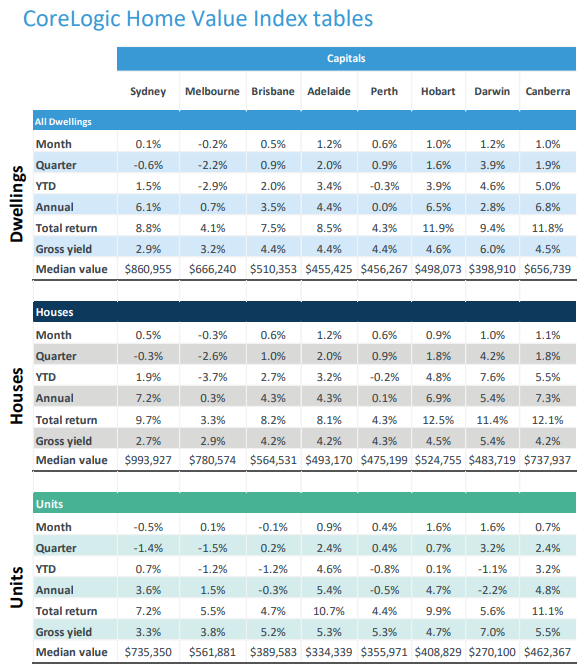

The latest data from CoreLogic show house values grew 1.1 per cent in October to a median price of $737,937, and 1.9 per cent for the quarter and 7.3 per cent for the year. Just this year house values have increased 5.5 per cent.

Last weekend’s auctions continued the trend of greater numbers and high clearance rates, with three inner-city properties breaching the $2 million mark.

Sixty-four houses were listed for auction last weekend, and 57 were reported, with 46 sold for a clearance rate of 80 per cent and a median price of $815,000.

Top of the pile was 71 National Circuit in Deakin with a sale price of $2,675,000, followed by 22 Gunn Street at Yarralumla ($2,605,000) and 20 Dirrawan Gardens at Reid ($2,190,000).

Outside of auctions, well-presented houses at the cheaper end of the market are proving quick to sell, taking very little time to attract offers with keen competition in the range between $400,000 to 600,000.

Unit values keep rising too, up 0.7 per cent for a median of $462,367, and a hefty 2.4 per cent for the quarter. Overall, Canberra home values are up 1 per cent for a median of $656,739, and 1.8 per cent for the quarter.

CoreLogic Home Value Index tables. Image: CoreLogic.

The Commonwealth’s HomeBuilder is also doing its job with lending for construction of a new home in the ACT to owner-occupiers up 6.2 per cent in September, but its full effects are still to flow through the market.

While the COVID-19 economic crisis has dragged down the big markets of Sydney and Melbourne, Canberra, with its solid public sector employment base and strong response to contain the virus, has remained resilient and now the market is bubbling and in need of fresh stock, particularly freestanding houses, to feed demand.

After five months of consistent declines nationally, CoreLogic’s national home value index moved back into positive month-on-month growth through October, posting a 0.4 per cent rise.

Every capital city apart from COVID-hit Melbourne enjoyed a rise in values over the month but since the announcement that private home inspections were once again permitted, new property listings have surged, clearance rates have lifted and buyer activity is recovering.

Joining Canberra with rises of more than 1 per cent were Brisbane, Adelaide and Hobart.

According to CoreLogic’s Head of Research Tim Lawless, the October results show early evidence of a divergence between house and unit market performance due to a decline in migration and international student numbers.

“Almost two-thirds of Australian units are rented, and rental conditions have weakened, especially in the key inner-city precincts of Melbourne and Sydney. These areas have a higher concentration of unit stock, and historic exposure to demand from overseas migration,” Mr Lawless said.

“Low levels of investment activity, relatively high supply of unit stock in inner-cities and international border closures are key factors that imply units will under-perform relative to houses over the medium term.”