Where the action is: Units and townhouses are now the focus of buyers. Photo: Michelle Kroll.

Canberra’s housing market appears to be coming off the boil as buyers switch their focus to more affordable units and townhouses.

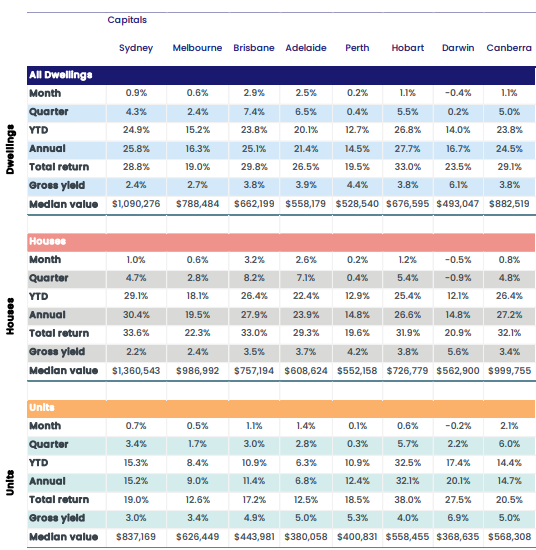

The latest CoreLogic report shows Canberra still posting a 1.1 per cent overall rise in November, but the demand for houses seems to be easing.

House prices rose by just 0.8 per cent, less half the increase in October, while units and townhouses edged up over 2 per cent, reflecting the fact that many people, especially first-home buyers, are realising that the standalone home is now well beyond their budgets.

Last weekend’s auction activity was busy enough with a 79.5 per cent clearance rate for 70 properties sold, but word is attendances were down at open homes for free-standing properties, although there are still enough to pull out big bids, especially in the inner north and south.

There may have been more sellers with 112 properties listed for Saturday, but many were looking elsewhere or not not all.

The top 10 results started at $2,590,000 for a four-bedroom home in prestigious Yarralumla and the bottom came in at $1,450,000 for a four-bedroom home in Lyons.

The lowest result was for a two-bedroom unit in Dickson at $446,000, but the cheapest house was a three-bedroom property in Ngunnawal at $710,000.

The median price for a house in Canberra now stands at just under the million-dollar mark, higher than Melbourne, while units and townhouses are more than half that at $568,000.

CoreLogic Home Value Index Tables. Image: CoreLogic.

House prices have gained a phenomenal 26.4 per cent for the year, adding more than $230,000 to the median figure, and 27.2 per cent over the past 12 months.

Unit and townhouse prices have enjoyed nearly half that growth at 14.4 per cent and 14.7 per cent, adding about $100,000 to the median, but over the last quarter, they have surged 6 per cent compared with 4.8 per cent for houses, the highest growth in the country.

CoreLogic research director Tim Lawless said a number of factors were combining to produce the softest result nationally since January – higher fixed mortgage rates, more listings and affordability barriers.

Houses continued to outperform units, with capital city values up 1.2 per cent and 0.7 per recent respectively over the month, but the gap is narrowing, with the quarterly rate of growth now the narrowest since October last year, with 1.6 percentage points between the two housing types.

CoreLogic says prices were still expected to rise in 2022, but the trend towards slowing growth is likely to continue into next year and beyond, with most of the factors that have been pushing housing prices higher either diminished or expired.

But low mortgage rates are still expected to support demand, with variable rates not about to shift until the Reserve Bank moves on the cash rate.

Affordability, particularly in the house market, is becoming more challenging by the month, and demand for higher-density housing is likely to increase in 2022.

The big banks have predicted prices to recede in 2023, even in Canberra where high incomes and stable government jobs have been the ingredients for steady growth.

The Commonwealth is the most bearish, predicting prices in Canberra to drop 10 per cent.

But with government work booming and public service employment numbers up 2.3 per cent on last year, that favourable economic environment is unlikely to change any time soon.