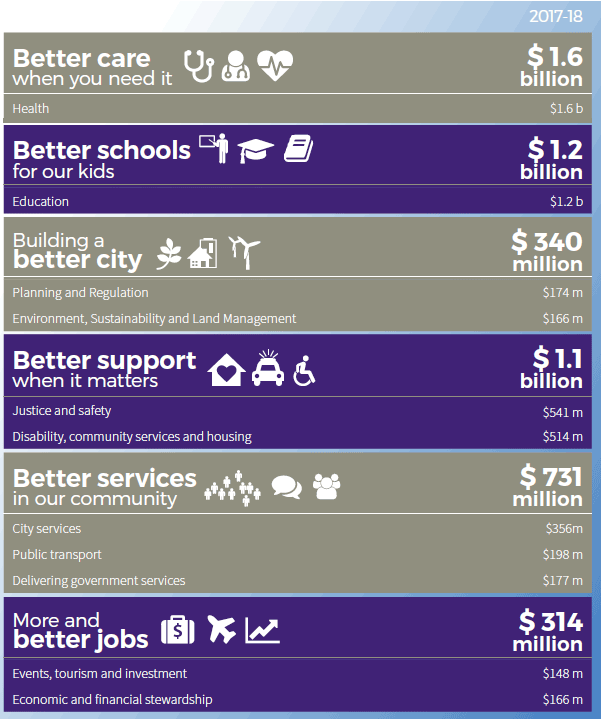

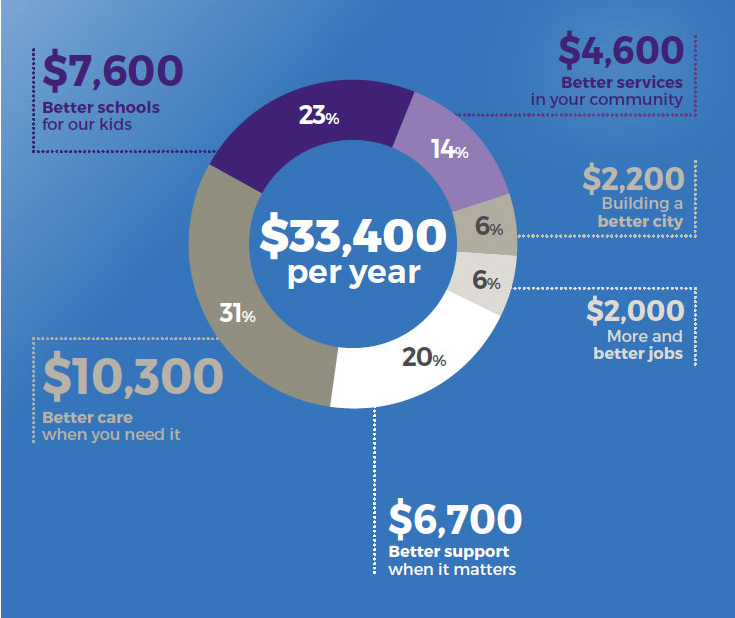

Where our money went in 2017-18. ACT Government graphic.

First things first: It’s time to abolish the archaic practice of the budget lock up. This is the antiquated practice of confining journalists to a space for hours, with thousands of pages of budget-related material to digest prior to it being presented to the Assembly by the Chief Minister, Andrew Barr.

Draft guidelines for the ‘lockup’ included: no wifi and no broadcasting etc. But hey, folks, we all had our mobile phones, cellular watches, laptops etc. and were even encouraged to visit government websites to access documents …

So please, spare us this nonsense next year and do away with the ‘ACT Budget lockup’. Just give us the documents and enforce an embargo till 3 pm.

Although the sandwiches and coffee were pretty good – and the access to senior public servants was excellent – and the time spent mulling over how our ACT $5 billion economy is being run, was well spent.

For me, the highlight of the 2018-19 Budget was that Chief Minister Andrew Barr kept his tinder dry leading up to the budget. As opposed to the entire rest of the budget being announced by his Ministers in a veritable tsunami of announcements.

So, let’s start with the biggie:

Abolition of stamp duty for first home buyers

- Announced in the 2018-19 Budget but not coming into effect until 1 July 2019 ie the 2019–20 is the abolition of stamp duty for first home buyers.

Now this is a biggie, but don’t get too excited, it will be capped to first home buyers with a maximum household income of $160,0000 and the un-means tested $7,000 First Home buyers Grant will be abolished at the same time.

Cynically, I thought this might be a saving, but there is an actual cost to the budget of around $1.3 million dollars.

The Chief Minister said in his budget speech that “by 2021-22, someone buying a $500,000 house would be paying off half the amount of stamp duty they would have been up for when we started this reform – a saving of $10,500.”

But digging further, the median house price is actually $530,000 and the estimated stamp duty saving would be $12,696 … but of course, the average house price is around $650,000.

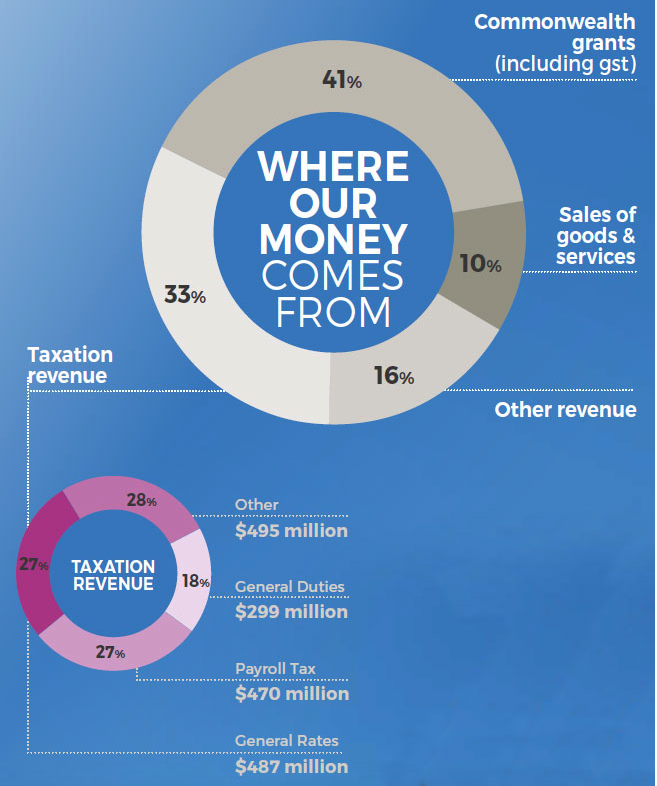

We are currently seven years into the ACT Government’s 20-year plan to abolish stamp duty for all and modernize our revenue base.

No other state or territory is following the ACT Government’s brave lead in this regard. Of course, that is because rates and stamp duty are split between state and local governments and it’s all a bit hard to sort out – but no problem here in the ACT.

Where our money came from in 2017/18. ACT Government graphic.

Other highlights in 2017-18 included:

- $5.4 billion economy returned to surplus – $31.9 or 0.59%;

- Surplus after 5 years of deficit;

- ACT Economy grew at 4.6%;

- ACT maintains a AAA credit rating (only one of three states and territories to do so);

- Tertiary education exports grew by over 24.4% to $750 million;

- Construction of private dwellings grew by 25%;

- Employment growth was 2.7% or 6,000 jobs;

- Unemployment sits at 3.7%;

- 3,200 jobs created (80% full-time);

- Fastest growing economy of any state or territory; and

- Larger economy than Tasmania and the Northern Territory and forecast to be larger than South Australia.

Most of the other initiatives in the ACT Budget 2018–19 were already announced prior to the ACT Budget and include:

Health:

- $443 million in new investments

- Building on $1.6 billion spent each year

Schools:

- $210 million new money in local schools

- Building on $1.2 billion spent each year

Mowing, weeding and cleaning up graffiti:

- $8 million landscaping, infrastructure and traffic improvements to the Tuggeranong, Kambah and Gungahlin centres

Community and Public Housing:

- Continue $608 million public housing renewal program

- 72 more properties in 2017-2018

- $1 million to strengthen and expand homelessness services

- $10.1 million to strengthen frontline teams within the Child and Youth Protection Service

- $33.7 million to support children and young people who cannot live in their family homes

Further facts, figures, media releases, budget papers and facts can be found at the ACT Government Chief Minister, Treasury and Economic Development website.

What does this year’s ACT Budget mean from a business, investment and property perspective?

What does this year’s ACT Budget mean from a business, investment and property perspective? The RiotACT came to you LIVE from the National Press Club of Australia to bring you reaction and analysis from three Canberra experts. Robyn Hendry of Canberra Business Chamber, Archie Tsirimokos from Meyer Vandenberg Lawyers and Andrew Sykes from RSM Australia shared their responses to the key Budget issues and what the new measures mean for business in the ACT.

Posted by The RiotACT on Tuesday, June 5, 2018

Prelude:

I have to say that the Barr Government is a smooth machine that rolled out the pre-budget like seasoned professionals.

There are of course serious issues that are facing the ACT in coming years and these all relate to ‘growth’.

My colleague and I debated the word of this year in the ACT Budget. He said the word was ‘balance’. I said it was ‘growth’.

‘Growth’ and ‘growing’ is all over the budget papers, speech and media releases.

Whilst the Chief Minister, Andrew Barr, highlighted ‘balance’ in terms of the economy.

But it is ‘growth’ that is both the engine that is driving our stunning economic figures and leading to many headaches in terms of how we continue to deliver the high levels of services that we have become accustomed to and demand in the ACT.

What mark do you give the ACT Government out of 10 for their managing of the ACT economy and why?

2018-19 ACT Budget

- ACT economy ‘back in the black’ but challenges loom

- ACT Budget: Rates up 7 per cent, stamp duty to go for first-home buyers

- ACT Budget: Help for the homeless with more to come

- ACT Budget: Design work to start on a new Canberra Theatre Complex

- ACT Budget: $12.5m for light rail Stage 2 planning, plus start on Mitchell stop

- ACT Budget: Government to spend $9 million in bid to boost teacher skills

- ACT Budget: $1.8 million to help people through NDIS transition

- ACT Budget: $112 million for Canberra Hospital to boost ED and cut surgery waiting lists