Independent Woden sold 13 Galbraith Close at Banks for $1.21 million, a suburb record. Photo: Independent Woden.

Canberra’s housing market has gone into the spring selling season in good shape, chalking up another rise in home values and strong auction results from the weekend.

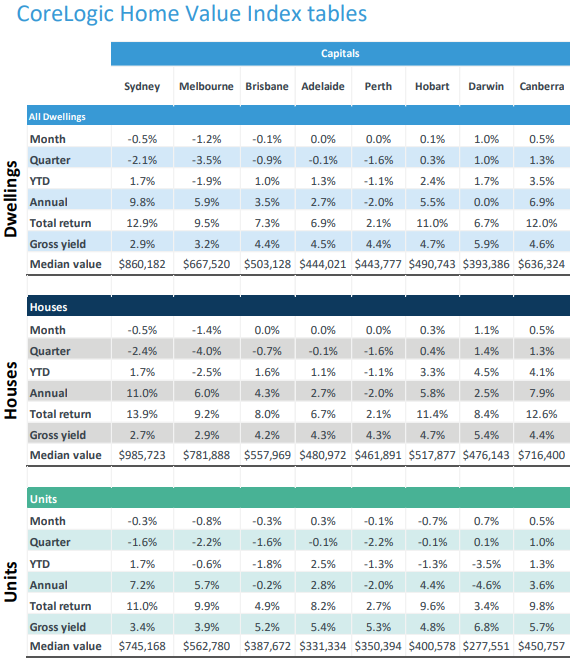

The latest monthly data from CoreLogic shows Canberra defying the downward trend in the two big markets of Sydney and Melbourne, recording a 0.5 per cent rise overall in August and houses and units up by the same amount.

This translates to a 1.3 per cent rise for the quarter and 6.9 per cent for the past 12 months.

For houses it was a 1.1 per cent rise for the quarter and 7.9 per cent for the year, while units went up 1 per cent for the quarter and a more modest 3.6 per cent over the 12 months.

The year-to-date figures show how well the Canberra market has negotiated a difficult year, with house values up 4.1 per cent and units 1.3 per cent, for an overall gain of 3.5 per cent.

Stand-alone houses more than held their value, but units are picking up after a slight dip earlier in the year and a couple of flat months.

Last weekend in glorious spring conditions, there were 46 properties listed, delivering a clearance rate of 81 per cent, with 13 results over the million-dollar mark. Nine were passed in, seven sold prior to auction, and eight had their prices withheld.

Aranda, Banks, Bruce, Duffy, Fisher, Franklin, Isaacs, Macquarie, Mawson, O’Connor, Waramanga, Weston and Yarralumla attracted winning bids over $1 million.

In Yarralumla, the five-bedroom property at 8 Turner Place went for $2,582,000, the highest reported price of the weekend.

Last week on 26 August, 56 Samaria Street in Crace sold for $1.39 million.

By comparison, in week 34 of 2019, there were only 23 auctions, with 15 sold for a clearance rate of 65 per cent.

The median price for August was $1,025,500.

The CoreLogic Home Value Index highlights the strength of the Canberra real estate market. Image: CoreLogic.

Independent Woden principal Mark Wolens said the market was strong across the board with not enough stock listed to meet demand for well-presented properties, houses or apartments.

He said buyers had been out in force with solid numbers seen through exhibitions and attendees on auction day.

His firm sold a five-bedroom house at 13 Gailbraith Close in Banks on the weekend for $1.21 million, a suburb record.

”Canberra is such a resilient strong market and it continues to be strong,” he said.

Mr Wolens said money was cheap, there was high public sector employment and it was easy to change over properties at the moment.

The market was gathering momentum from Gungahlin to Tuggeranong, he added.

”People want to live in every area of Canberra.”

Mr Wolens said the government’s Homebuilder grant was also helping the market for new properties.

The industry had always believed Canberra would come out of the COVID-19 situation well, and he expected those who had held back their properties in March and April would now return to the market.

In contrast, CoreLogic reported that national home values moved through a fourth month of COVID-induced falls, with the CoreLogic home value index recording a 0.4 per cent fall in August.

But it found the rate of decline had eased over the past two months and five of the eight capitals recorded steady or rising values through the month.

Head of research Tim Lawless said the main drag on the national result was Melbourne where home values have fallen by 4.6 per cent through the COVID-19 period.

National listings were down a further 11.5 per cent, which Mr Lawless said was helping to insulate home prices.

This could change if pandemic supports fall away at the end of the month and the number of distressed sales increase.

“If we do see active listing numbers rising to be higher than previous years, it could signal that vendors will need to offer up greater discounts in order to sell their home,” Mr Lawless said.

Overall, CoreLogic identified that markets are diverging according to the impact of the pandemic on particular regions.

In economically stable, COVID-free Canberra, the housing market is showing rude health, if a little short on well-presented stock.