Interest rates are still taking a bite out of Canberra’s property values. Photo: Michelle Kroll.

Canberra property values continued to slide over January in response to the Reserve Bank’s inflation-fighting, but the worst of the decline appears to be over.

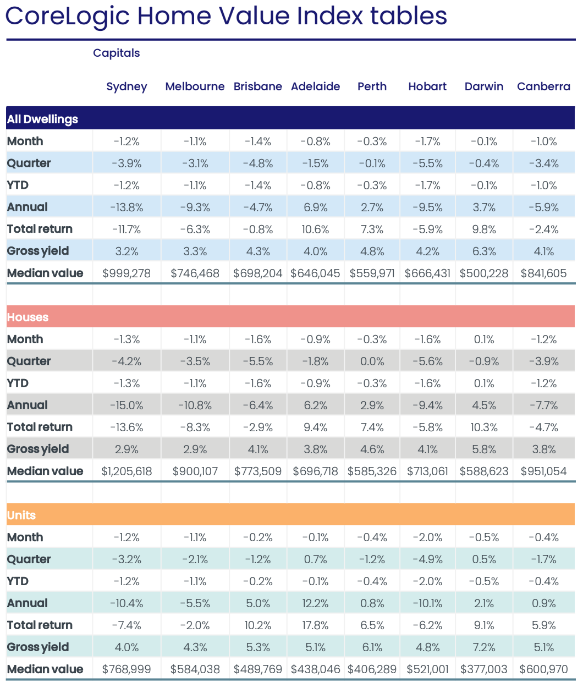

The CoreLogic Home Value Index for January shows an overall fall of 1 per cent, with houses at -1.2 per cent declining more than townhouses and units (-0.4%), which continue to hold their value better.

Since the market peaked in June, residential property in Canberra has dropped 8.6 per cent in value, or about $79,000 on average, as successive interest rates bit.

Since the June peak, medium to high-density properties have fared much better than houses, falling just 4 per cent compared with 9.9 per cent for the standalone home.

CoreLogic Research Director Tim Lawless said this reflected demand towards the more affordable side of the market. However, the oversupply issues Canberra had been contending with a few years ago seemed to have resolved themselves through a slowdown in building as well as a pick-up in demand.

“I don’t think supply is weighing on unit prices any more like they did over the past decades,” he said.

But Mr Lawless said most homeowners remain well in the black given the upswing between the COVID trough and the peak lifting values a massive 38.3 per cent in Canberra, or about $255,000 on average.

Home value tables for Australian capital cities. Image: CoreLogic.

The Canberra market was up 26.4 per cent since the start of the pandemic in March 2020, so only those buyers who purchased through 2022 may be seeing the value of their home falling to less than what they paid for them, he said.

Mr Lawless said it was probably unsurprising to see the market behaving like this after such a solid upswing and considering what was happening with interest rates.

And there was still some way to go, although there was a silver lining for homeowners.

“We’re not seeing any evidence that the market’s about to bottom out but maybe the good news ahead for homeowners is that the rate of decline in Canberra has been easing off,” Mr Lawless said.

He said Canberra moved through the worst of it over the September quarter with a 4.4 per cent slump, but the rolling three monthly figure was back to 3.4 per cent to the end of January.

“So still a quite rapid rate of decline but not quite as bad as the rate leading into spring,” he said.

Overall, it has been the largest and fastest decline in values since at least 1980 when CoreLogic’s records began.

The Canberra market in January traditionally goes into recess with so many people on leave and out of town, but sales and demand generally have fallen away.

New capital city listings added to the market over the four weeks ending 29 January were 22.2 per cent lower than over the same period last year and 24.5 per cent below the previous five-year average.

Every capital city recorded a below-average number of new listings through January, reflecting an ongoing reluctance from sellers to test the market.

“Such a low number of new listings implies most homeowners don’t need to sell; rather, they seem to be prepared to wait this downturn out,” Mr Lawless said.

“This trend of lower than normal levels of new listings has been persistent through spring and early summer and looks to be continuing into 2023.”

Capital city dwelling sales over the past three months were estimated to be 29.4 per cent lower relative to the same period in 2022 and 11.5 per cent below the previous five-year average.

Mr Lawless said it was unlikely listing and purchasing activity would return to average levels until consumer sentiment started to improve.