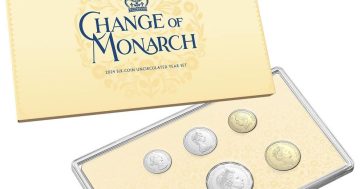

Orders of new coins from the Royal Australian Mint have spiked despite the ongoing COVID-19 pandemic. Photo: Royal Australian Mint.

Demand for coins has doubled and demand for notes has tripled in Australia during the past year despite a push for cashless transactions in the COVID-19 pandemic.

It seems almost every business now has signs encouraging customers to use card or electronic transfer instead of cash to lower the risk of COVID-19 transmissions.

So it comes as a surprise that demand for cash has significantly risen.

The Royal Australian Mint in Canberra says it put approximately 175 million new coins into circulation during the 2020-2021 financial year.

That’s almost twice the 91 million total in 2019-2020.

Royal Australian Mint’s chief executive officer, Leigh Gordon, said it was unexpected.

“We’ve been quite surprised by the demand for coins we’ve seen during the past 12 months,” he said.

“[It’s] more demand for circulating coins than we expected across the period of COVID-19.”

The Reserve Bank of Australia (RBA), which oversees the nation’s banknote production and circulation, also saw a surge in demand during the pandemic.

An RBA report released in March this year found that from March 2020 to February 2021, the value of banknotes in circulation rose 17.1 per cent to $97.3 billion.

That’s more than triple the average growth of five per cent per year during the past decade.

The Reserve Bank of Australia says people are holding onto cash, especially $50 notes, as a precaution. Photo: Damien Larkins.

Demand grew mostly for larger notes, with $50 notes comprising around 70 per cent and $100 notes 20 per cent.

The RBA puts the spike down to people holding onto cash as a precaution or to store wealth.

“The demand for cash during the COVID-19 pandemic has likely been driven by hoarding behaviour,” said the report.

“[Possibly] a general sense of uncertainty or because they were concerned about possible disruptions to electronic payment systems during the pandemic.”

Mr Gordon said notes and coins are generally preferred for small transactions by older people and in teaching financial literacy.

But cash in hand also provides a sense of security during tough times.

“People just take hold of their cash across the period of uncertainty,” said Mr Gordon.

“[In] the bushfires that we had, there was a time there down on the South Coast where the EFTPOS machines were down and there was no power.

“You had to pay for your fuel with cash.”

Most businesses moved away from cash transactions during the COVID-19 pandemic. Photo: Damien Larkins.

The majority of the extra production was for the lower-denomination silver 5 cent, 10 cent, 20 cent and 50 cent coins.

Interestingly, $1 coins didn’t experience the initial spike in demand.

Mr Gordon said the South Australian Government’s move to allow poker machines to accept notes in late 2019 caused the anomaly.

“[Gaming organisations] actually gave their stocks of $1 coins back into the circulating pool and they got redistributed,” he said. “So we went for a few months where there weren’t many $1 coin demands.

“But they have started up again with the recent demands from the banks. The system has rebalanced itself.”

The $1 coin was least in demand during the COVID-19 pandemic due to an influx from South Australia. Photo: Royal Australian Mint.

Stockpiles of coins are held by the Royal Australian Mint to accommodate demand fluctuations and trends.

But it can ramp up production when required.

“We can see that buffer stock starting to be drawn down on and we can start producing it ourselves,” said Mr Gordon.

“We can respond in three months to something like this.”

The Royal Australian Mint doesn’t expect coin demand to snap back to pre-pandemic levels any time soon.

“It’s been a blip up to a new level that’s going to start decaying down,” said Mr Gordon.

“We’re expecting increased demand will probably reduce, but will continue at a higher number during the next couple of years.”

He said the Royal Australian Mint is focusing on growing investment in collectible coins in the long-term future.