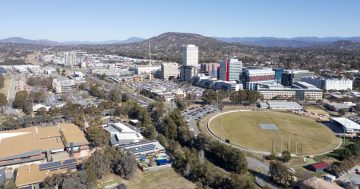

DDCS Lawyers provide a full suite of Wills and Estate Planning legal services. Photo: Thomas Lucraft.

If you’re reading this, chances are you’re thinking about making a will. Perhaps you have passed a major milestone – purchased a property, recently married, welcomed a child, or lost a loved one. While these key moments are common triggers, anyone over the age of eighteen should have a will in place.

With much stake, a will is perhaps one of the most important documents that you will craft in your lifetime. So too is the decision of which lawyer you engage to assist.

Whether you’re drafting a will, setting up a trust, or navigating probate, a skilled wills and estate lawyer can help you make informed decisions and avoid potential legal pitfalls.

In this article, we’ll outline the qualities to consider when choosing a wills and estate lawyer and share where to find the best in Canberra.

What makes a great wills and estates lawyer?

The right lawyer can simplify the estate planning process and provide peace of mind for you and your loved ones. Here are the key traits to look for:

- Expertise in estate law. A great wills and estate lawyer brings extensive knowledge and years of experience in estate law, including drafting wills, establishing trusts, and managing probate matters. They stay updated on changes to legislation and legal requirements, ensuring that your estate plan is both current and compliant.

- Clear communication. Estate planning involves complex legal language that can be overwhelming. A skilled lawyer takes the time to explain these terms and processes in a way that is easy to understand, empowering you to make well-informed decisions. They should also be approachable and open to answering all your questions, ensuring that you feel confident throughout the process.

- Attention to detail. Estate documents need to be precise to prevent legal disputes or misinterpretations. A meticulous lawyer ensures that every aspect of your estate plan is accurately documented, from the naming of beneficiaries to the allocation of assets. They will also double-check for compliance with relevant laws and regulations, giving you peace of mind that your wishes will be upheld.

- Compassionate approach. Discussing wills and estates can be an emotional process, particularly when dealing with end-of-life planning or the loss of a loved one. A compassionate lawyer understands these sensitivities and provides a supportive and empathetic environment. They help ease your stress and guide you through challenging conversations with care and respect.

- Proactive problem-solving. Effective estate planning involves anticipating potential challenges, such as tax implications, disputes among beneficiaries, or unforeseen changes in your circumstances. A proactive lawyer identifies these issues early and offers practical, tailored solutions to address them. This forward-thinking approach ensures that your estate plan is robust and adaptable to future needs.

The best wills and estates lawyers in Canberra

Riotact’s editorial team has combed through 20 years of on-site comments to compile a list of the most recommended businesses according to you.

To be listed in our Best of Canberra series, each business needs to have consistently received positive feedback on Riotact and maintain a minimum average of 4/5 stars on both Google and Facebook reviews.

DDCS Lawyers

Award-winning Canberra law firm DDCS Lawyers has built a solid reputation for some of the best legal advice in the nation's capital, including a full suite of wills and estate planning services.

DDCS' experienced lawyers bring with them diverse backgrounds and carefully honed skills. The firm has helped thousands of clients protect both their own assets and those of their loved ones since opening its doors in 2007.

Wills and estate planning services include estate disputes, probate and deceased estate administration, enduring power of attorney arrangements, testamentary trust arrangements, Elder law and more. DDCS also practices within family law and business succession.

DDCS knows what matters most. They offer a client-centred approach and are genuinely committed to ensuring the best outcome possible. The firm prides itself on being highly respected by clients, other professionals and the wider legal sector.

"We had been to a number of family lawyers before approaching DDCS Lawyers, but we are now so happy to have found Theresa," Adam D says online.

"She was easy to talk to, and she listened. It made us feel confident she would recommend the best course of action for our family situation. Moreover, she very professionally and patiently explained various aspects of estate arrangements..."

MV Law

MV Law delivers expert legal advice, guidance and representation for everyday Canberrans from all walks of life.

The team of multi-disciplinary professionals offer hassle-free wills and estate planning services tailored specifically to clients' needs, including Elder law, deceased estate, probates and disputes, power of attorney and more.

As specialists in the wills and estates sector, the team has a unique perspective related issues that can, and do, occur. They're able to consider every aspect of the law in order to plan for and advocate on clients' behalf accordingly.

MV Law recognises how important it is to be understanding and empathetic when handling wills and estates. Solicitors always consider clients’ best interests as their number one priority - Canberrans can be confident their assets will be protected and distributed to beneficiaries as intended when the time comes.

The team’s stellar qualifications speak for themselves. Four of MV Law's expert lawyers were recognised in The Best Lawyers in Australia 2021 List, and have received legal peers: Doyles Guide recognition as leaders in estate succession planning and wills and estates litigation.

As Terri Stiller writes in their Google review, “I went to [MV Law] to have my Will and EPOA drawn up. The service I received was outstanding, even through COVID 19 lock down period."

"They kept in touch, progressed my documents and gave me safe and secure options to submit my documents back to them. I found all the staff I had contact with to be friendly, professional and very helpful.”

Snedden Hall & Gallop

As one of Canberra’s oldest law firms Snedden Hall & Gallop have built an enviable reputation that spans almost sixty years. Their experience, personal, and dependable team are exemplary practitioners who are there for their clients in the best - and the worst of times.

The firm's wills and estates department knows how important it is that every adult has a properly prepared will that ensures their estate is left to the people they care about. It's led by Julia Bridgewater, whose background in accounting, law and running a family farm provides unique insight into how businesses and families work.

Julia and her team cover every part of the wills and estates sector, including testamentary trusts, estate disputes, family provision claims, and probate and estate administration. They work closely with all clients to ensure personal wishes are reflected in their will and other estate planning documents with strength and accuracy.

"We have been using Snedden, Hall & Gallop Lawyers for some years now, they have looked after us with our wills and commercial/business needs... [and] have been nothing but professional, friendly, helpful and looked after our best interests," Alayna Sixsmith wrote in a glowing review on Google.

BDN Lawyers

Drafting wills can be a confronting process, requiring careful consideration and attention.

Luckily, BDN Lawyers has serviced the legal needs of those in the Canberra and Queanbeyan region for more than 150 years - their solicitors have more than enough experience to ensure the entire process runs as smoothly and efficiently as possible.

BDN's services in this field include estate administration, grants of probate, testamentary trusts, contested wills, powers of attorney, and appointment of enduring guardian (for NSW clients).

BDN also has a handy online will kit, which captures client wishes at any time, allowing their lawyer to craft a valid will thereafter. This ensures affairs are easily secured in preparation for the future.

"Professional, efficient and friendly. Spent time following up and explaining details we were unsure of and made all necessary arrangements to organise our affairs in a timely manner," Mike Hutchings wrote on Google.

BAL Lawyers

Situated in the heart of Canberra, BAL Lawyers boasts a stellar reputation and impressive track record for achieving positive client outcomes.

The team takes a holistic approach to estate planning, also providing personalised advice on non-standard or complex legal issues in estates and guardianship matters.

Gabrielle Meyer wrote on Google, "I engaged BAL to manage my Mother’s estate. I appreciated the clear advice, prompt action and follow up along with timely and helpful communications. I intend to use the firm for future legal matters."

Are you looking for more recommendations of legal services in Canberra? Check out our articles on the best law firms, the best business lawyers, best commercial lawyers, best divorce lawyers, best criminal lawyers, best personal injury lawyers, best consumer lawyers, best DUI lawyers, best bankruptcy lawyers, best employment lawyers, best conveyancing lawyers, best workers compensation lawyers and the best sports lawyers in Canberra.

If you’re after specific advice on immigration, read through our articles on the best immigration lawyers and the best migration agents in Canberra.

Or, if you’re looking to resolve your situation outside of the court system, our article on the best mediation and conflict resolution services in Canberra may be helpful.

Your experience with wills and estates lawyers in Canberra

Thanks to our commenters who have provided insightful feedback. If you believe we have got it wrong, please let us know.

Have you had experience with any of the law firms listed above? If so, share your feedback in the comments below.

Frequently Asked Questions

What is a wills and estate lawyer?

Wills and estate lawyers specialise in managing your legal and personal affairs leading up to and in the event of your death. They help clients to draft wills and trusts, elect executors and trustees, and produce other documents that will assist with the administration of the your estate once you have passed away, or during periods when you are incapacitated.

Why should I hire a wills and estate lawyer?

While DIY wills do exist, there are numerous and specific requirements that determine their legitimacy, and an improperly drawn one can invite challenge or dispute. A wills and estate lawyer is fully trained in the construction and management of wills, and will be able to ensure that your will is properly and legitimately drawn up so as to avoid any headaches down the line.

Do I need a will?

Generally, you should draw up a will when you get married, have kids or have a positive net worth. However, many lawyers advise getting a will before this as dying without a will means anyone you have had a significant relationship with (including past partners and estranged family members) can have a claim on your estate.

What do I need to consider when drawing up my will?

There are many things to consider when drawing up your will - for example, who the executor will be, who the beneficiaries will be, and what you are going to include in your will. Consulting a wills and estate lawyer and making sure that your will is being drawn up in accordance with your state's laws is the best way to ensure that all the requirements are met and nothing crucial is forgotten.

What assets can I include in my will?

Will assets can include things like personal items, bank accounts, insurance policies, businesses and properties. If there are some assets or instructions you wish to include in your will that you're unsure about, consult your wills and estate lawyer and get their professional, legal advice on the matter.